Solar securitisations and tax equity structures in the US

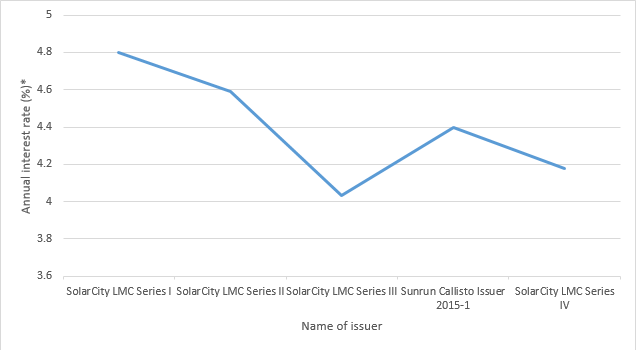

Securitisations provide one of the cheapest sources of capital for residential solar assets. Since November 2013, five solar securitisations have closed in the US. Pricing on these securitisations may reflect the varying risk of the tax equity structures involved.

Market observers warn against simplifying the determinant of pricing to tax equity risk. Numerous other factors – including the interest rate environment – can impact the pricing of any given securitisation. However, most agree that tax equity is a key risk factor.

|

|

SolarCity LMC Series I |

SolarCity LMC Series II |

SolarCity LMC Series III |

Sunrun Callisto Issuer 2015-1 |

SolarCity LMC Series IV |

|

Close/pricing date |

21-Nov-13 |

2-Apr-14 |

24-Jul-14 |

9-Jul-15 |

13-Aug-15 |

|

Tax equity structure |

None |

None |

Inverted lease |

Inverted lease |

Partnership flip |

|

Annual interest rate (%) |

4.8 |

4.59 |

4.03 (A notes) / 5.45 (B notes) |

4.4 (A notes) / 5.38 (B notes) |

4.18 (A notes) / 5.58 (B notes) |

|

Total size of issuance (US $m) |

54.425 |

70.2 |

201.5 |

111 |

123.5 |

|

Ratings agency |

S&P |

S&P |

S&P |

Kroll |

Kroll |

|

Rating (according to pre-sale reports) |

BBB+ |

BBB+ |

BBB+ (A notes) / BB (B notes) |

A (A notes) / BBB (B notes) |

A (A notes) / BBB (B notes) |

Partnership flip

Pricing on SolarCity’s securitisations decreased sequentially from the first to the third, but increased on the fourth issuance. Generally securitisations tend to decrease in pricing as the market gains familiarity with the issuer. Pricing on SolarCity’s fourth issuance, however, likely increased because it was the first to feature a tax equity partnership flip. That structure introduces an element of cash flow risk.

*In instances where the securitisation features two classes of notes, the pricing reflects that of class A notes.

In the partnership flip, SolarCity initially owns 1% of the assets, while tax equity investors own 99%. In the first few years of operations, the tax equity investor receives the majority of the cash flow until a certain internal rate of return (IRR) is achieved. Once that IRR is reached, the cash flow “flips” such that SolarCity will receive the majority of the cash flow. Complications can arise if the cash flow from solar panels does not meet expectations, says Andrew Giudici, managing director at Kroll Bond Ratings Agency. That scenario could postpone the flip date, potentially reducing cash flow available for debt service.

Another potential risk arises when, for whatever reason, the US Internal Revenue Service (IRS) determines that the fair market value of the solar assets was overstated, Giudici adds. That could result in a recapture of tax credit, which could extend the flip date. Such a case could compromise cash flow to be paid to securitisation noteholders. To mitigate the risk of the recapture, SolarCity signed a tax loss insurance policy.

Inverted lease

SolarCity’s third securitisation and Sunrun’s first involved inverted lease structures. Even though SolarCity’s third securitisation introduced the inverted lease for the first time, pricing declined from the first two. That may reflect the lower risk posed by inverted lease structures.

In an inverted lease, the tax equity investor is a lessee that holds the right to the tax credit. In the event that the IRS recaptures the tax credit, the tax equity investor is “contractually prohibited from seeking indemnification from the Issuer until the notes are repaid in full,” according to Kroll Bond Rating Agency’s pre-sale report for Sunrun’s securitisation.

Sunrun’s securitisation, even though it also involved an inverted lease, had higher pricing compared to SolarCity’s third and fourth securitisations. Sunrun’s lack of securitisation issuance history may account for that premium.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.