News+: listed infrastructure funds in Thailand

Like most other developing nations, Thailand sees investing in its infrastructure as key to unlocking economic potential and maintaining the impressive growth rate it has notched up in recent years.

However the government’s ambitious plans to spend US$90 billion – or 20 per cent of GDP – improving the country’s roads, public transport, energy infrastructure and flood defences have run into choppy waters of late.

A spending programme due to go before parliament was not included in the latest three-month legislative agenda as the administration of Yingluck Shinawatra instead pushes through a controversial political amnesty bill, relating to demonstrations in 2006 when her brother, Thaksin, was ousted in a coup.

Analysts warn the delay could slow down growth in GDP, already revised downwards from 5.1 to 4.2 per cent by the Bank of Thailand, by a further 0.5 per cent this year.

Private capital

Another government initiative to pull in investment is gaining traction, though.

Although most of Thailand’s infrastructure is in public ownership, the plan is for private capital to finance a third of its expansion programme and to facilitate this the government last year drafted rules for the creation of listed infrastructure funds.

“Under the huge investment programme the government will have to ask for project finance from banks, both local and internationally, and is going to raise a lot of public debt. Funds are one way of releasing that burden,” says Anuwat Ruamsuke of Phatra Securities.

Under the regulation, these funds can invest in either physical operational assets or future cashflows emanating from contracted concessions – in essence an income fund. Rules stipulates a minimum fund size of Bt2 billion, while the investment assets must not be less than Bt1.5 billion, or Bt1 billion if multiple assets are acquired.

Shareholders buy units at an initial public offering (IPO) that can be traded on the Stock Exchange of Thailand. In most cases the sponsor company that owns the asset will also buy a tranche, limited to one-third of the total issue.

“It is effectively monetising the asset,” says one industry source.

As a protection to retail investors, the underlying assets cannot be more than 30 per cent greenfield developments – otherwise a private equity-style private placement must be adopted. A borrowing restriction means the debt to equity ratio at the fund level can be no higher than 3:1.

The advantage for infrastructure companies, many of which are heavily geared, is they can get cash upfront for capital expenditure without becoming more indebted, says Sorachon Boonsong, lawyer at Baker Mackenzie. The model is also attractive to banks.

“It means you can get some cash today rather than waiting for revenue in the future,” he says. “From the banks’ point of view, with Basel III and new accounting standards coming in, it is better to release [debt] transactions from their books. The bank instead becomes an arranger and underwriter of units in the infrastructure fund and collects a fee.”

There are equally compelling drivers on the demand side. Investors receive dividends tax-free and, depending on the degree of volume risk to which the underlying asset is exposed, there is a fairly attractive risk-adjusted return.

A dazzling debut

In April train operator BTS Group became the first to launch such a vehicle, raising Bt 62.51 billion (US$2.13bn) through the flotation of its The BTS Rail Mass Transit Growth Infrastructure Fund.

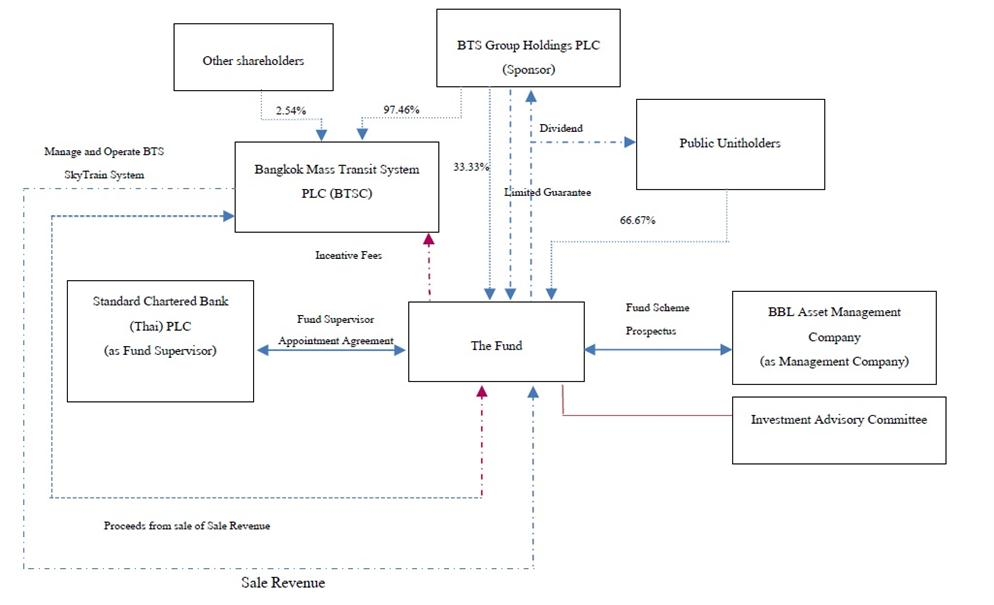

Rather than buying hard infrastructure assets, the close-end fund purchased the rights to future farebox revenue of the Bangkok SkyTrain - a 16-year unregulated monorail concession operated by BTS subsidiary Bangkok Mass Transit System PLC (BTSC, see diagram). In effect the fund paid upfront for a future cashflow whose quantum depends on the number of passengers using the rail service.

Fund manager BBL is to return 90 per cent of all net profits from the Skytrain revenues to as dividends investors, among whom are BTS and public unitholders.

The fund itself will pay an ‘incentive fee’ to BTSC to encourage it to manage the SkyTrain system efficiently and to control operation and maintenance costs.

Structure of the BTS Rail Mass Transit Growth Infrastructure Fund

A sign of the fund’s popularity was the massive oversubscription of the international tranche, which accounted for around 43 per cent of the deal, or US$909 million. This permitted managers to price the offering, which consists of 5.788 billion units, at the top end of the initial price range of 10.40 baht to 10.80 baht per unit.

Cornerstone investors, mostly big institutions, gobbled up 40 per cent of the BTS fund issue with BTS itself taking a third of shares. Domestic institutions accounted for around 2.3 per cent of units, according to one source, with the remaining 13.3 per cent subscribed to by retail investors.

Final pricing of fund shares at the initial public offering implied a yield of 5.8 per cent - an attractive return for investors looking for a steady income at a premium over sovereign bonds.

While the fund is only invested in one asset for now, it has the first right of refusal on similar concessions if BTS wins further projects from the government.

The BTS Group used a third of the proceeds from the revenue sale as an inter-company loan to roll over a bridge loan used to acquire it’s one-third of fund shares. Less than one-sixth of proceeds went towards a bank guarantee to secure bond repayments by SkyTrain operator BTSC.

BTS plans to use the other half of the proceeds to bid for four new rail lines.

Record breaking

The BTS infrastructure fund issue eclipsed the combined value of all listings in Thailand last year - some US$1.7 billion - as well as representing the biggest IPO in the Southeast Asian kingdom’s history.

Amid ravenous investor appetite for the low but steady-yielding returns of what is essentially an income fund, a rash of other infrastructure asset owners are also considering tapping equity markets.

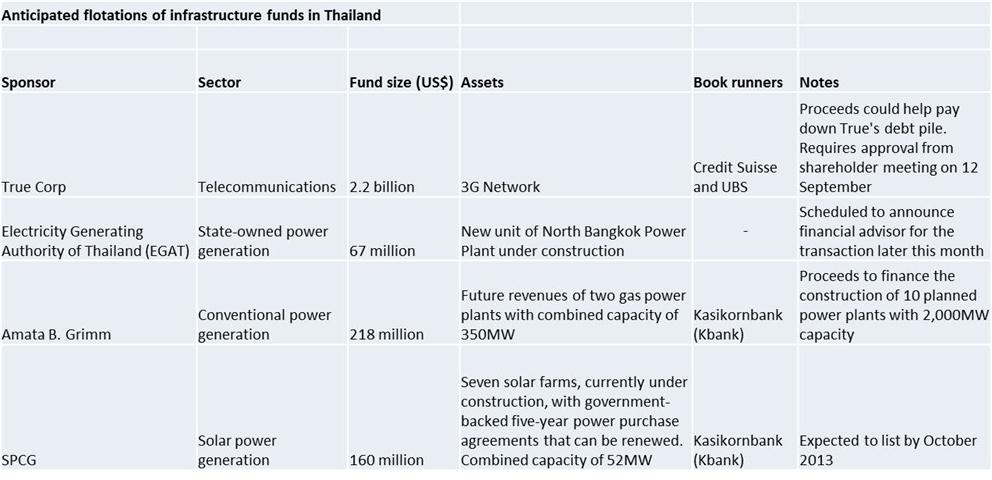

BTS’ record-breaking launch could yet be surpassed by a telecommunications offering from True Corp which is expected to raise some US$2.3 billion when it comes to market later this year.

IJ News understands that solar energy company SPCG is most likely to next step up to the plate with an offering giving exposure to the revenues of its power generation assets. Market rumours suggest an IPO worth US$100 to US$160 million in September. On top of this a number of other telecoms and power generation companies are also said to be considering launching funds.

Not risk-free

Clearly, any kind of infrastructure asset is never completely free of risk and investors will carefully need to examine the underlying asset and all the factors that could impact its cashflows. BTS, for example, can increase the unregulated fares on its Skytrain without government permission; but that runs the risk of both the economic cycle and potential consumer backlash. The safety of a power fund, meanwhile, is only as good as its offtaker and the power purchase agreement (PPA) underpinning the arrangement.

State-owned enterprises on the other hand are less likely to adopt the listed fund model. For a start, they have a cost of capital cheaper than the six to seven per cent cost of issuing a fund, says Ruamsake, while the influence of labour unions would make asset transfers tricky.

Analysts do not expect Thailand’s listed infrastructure funds to contribute that significantly to the overall budget being drawn up for Thailand’s infrastructure programme. But while parliament wrangles over politics, they have the potential to quietly put money to work.

“I believe most of the funds that are going to come out this later this year or early next will be cash-flow assignments, not directly investing in the hard assets,” predicts Phatra’s Anuwat Ruamsuke. "We expect another two or three this year".

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.