News+: Student accommodation financing

This summer has been an active one for bond financings by institutional invetsors for accommodation type PPP projects in the UK, particularly university student accommodation projects.

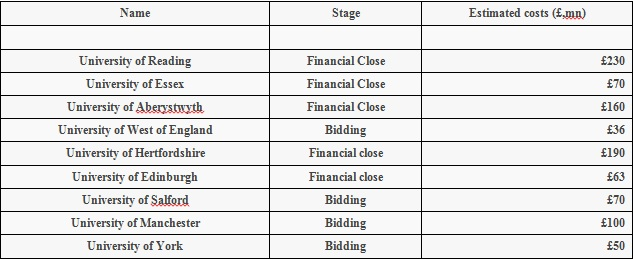

Most recently two universities issued bonds to finance their student accommodation projects. The University of Edinburgh's Holyrood accommodation deal involved monoline wrap company Assured Guaranty, while UK insurance company Legal & General bought bonds issued for the University of Hertfordshire student homes project. Following this, the Aberystwyth University accommodation project reached financial close with Legal & General providing 90 per cent of the required funding for the project with Balfour Beatty providing the remaining 10 per cent. It is understood that Aberystwyth University is leasing the premises from L&G's property fund. Another two ongoing procurements are also expected to be bond financed, sources say.

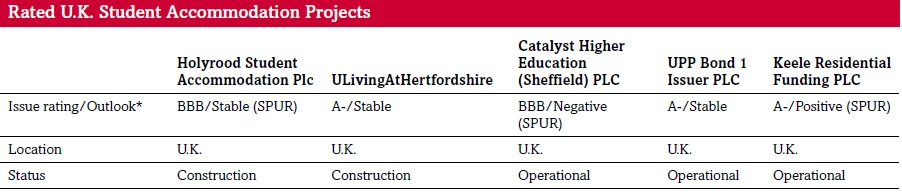

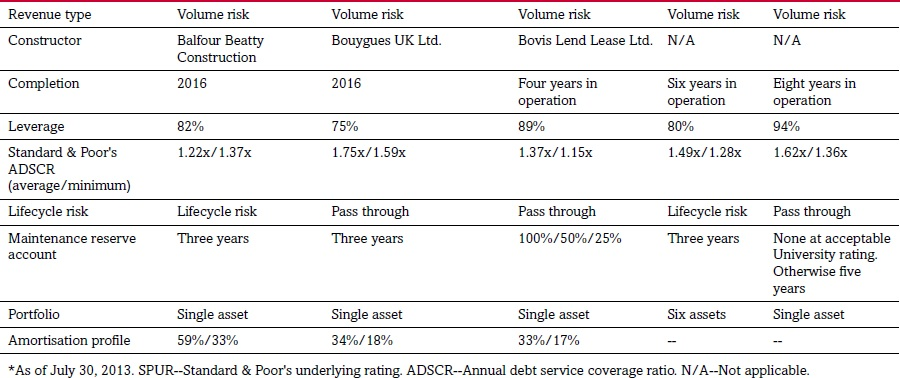

Lenders such as insurance companies and other institutional investors are fast becoming a good fit for financing these deals vis-a-vis banks, due to their long-dated debt requirements. The table below enlists the series of deals that have closed in recent times reflecting a strong interest of these players in such deals supported mostly by a bond issue:

As explored in a previous News+, the student accommodation sector itself has gathered a lot of pace in recent years, the reason being that a lot of universities around the UK have not refurbished their student estates since they were first built in the '1960s-70s. These estates are now in desperate need of rebuilding in order to keep up with the latest student demands - both technologically and socially. Therefore universities are now relying on the private sector for a complete overhaul of their student housing facilities.

Following is a table consolidating the current recently closed and in-bidding deals in the market at the moment:

Bond issuance in the UK student accommodation sector has shot up recently as student accommodation in the UK is already an established asset class, ratings agency Standard & Poor's notes in its recent report on the sector. In addition, the majority of university accommodation deals have very long-terms tenors (35-50 years) and prefer inflation linked financing, which makes them well suited for a capital markets solution such as bonds. Also, most of the projects have a strong backing from the host university which reduces several risk elements including student drop-outs or no-shows.

S&P's research showed that historically, student homes supply has been driven by higher student demand, the recruitment objectives of universities that compete against each other on their student offering, as well as increasing investor interest. "Up until recently, most of the new-build and refurbishment activity has been funded with bank debt and equity and has not included estate or facilities management (FM) outsourcing to the private sector. Today, we see more private finance initiative (PFI)-style student accommodation transactions in which construction, operations and maintenance, and lifecycle risks are transferred to a third party developer that also raises the project finance," the report stated.

Institutional investors say that they are also drawn to these deals due to their intrinsic stability. Georg Grodzki, head of credit research at Legal & General Investment Management also adds that, "investments in student accommodation remain strategic to us as they tend to be both commercially attractive and socially responsible." This is reinforced by the fact that demand for student housing is not forecasted to shrink even after the hike in fees administered by the UK government last year.

The UK is the second-most popular student destination in the world after the US and demand from international students continues to increase. Applications from overseas students rose 8.5 per cent between 2011 and 2012, and six per cent between 2012 and 2013, S&P said in its report quoting the Universities & Colleges Admissions Service. However the impact of the government's visa policies on occupancy levels and the respective university's own reputation are some risks that investors will continue to deal with on a case-by-case basis.

To the point about institutional investors and construction risk, Grodzki says it is a manageable risk for investors like them. "It is a myth in the market that only banks take construction risk." He says that not every type of construction risk is acceptable for investment grade investors but in this instance the risk was well mitigated.

Bond financing is also beneficial for these deals in-terms of the kind of pricing witnessed by these deals compared to that provided by banks. For instance, in the Holyrood student homes deal, bonds priced between 190 - 215 basis points above gilts.

But so far institutional investors have only found comfort with accommodation type deals which range between £150-200 million, which has so far restricted them just to this sector. It remains to be seen whether they will be able to up their game and participate more widely in other UK infrastructure sectors as well.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.