Infrafintech – problems, solutions & securitisation

The financial services industry’s embrace of financial technology continues apace. Kakao Bank’s W2.55 trillion ($2.2 billion) IPO in July 2021 valued the Korean internet-only bank at more than $16 billion. Payments startups had several megarounds at increased valuations during Q1 2021, including Klarna’s $1 billion raise.

DeepSee.ai’s nearly $23 million Series A in March showed momentum accelerating for automating capital markets processes while trade finance investors and originators welcomed Tradeteq’s more than $9 million Series A.

This story first appeared (open access) in The Global Digital Infrastructure Survey 2021 and associated report.

Incumbent financial institutions and fintech disruptors have been looking at blockchain to improve operational efficiency in financial services. It’s effectively used in commodity trade finance and logistics.

Companies now can track moving stocks on pallets. “In the old days, the warehouse certificate could be fraudulently re-used. Having blockchain in a closed group enhances security for that trade including KYC compliance,” says Tokyo-based Scott Neilson, project development and finance partner at Allen & Overy (pictured right).

Fintech has significantly enabled and disrupted nearly all aspects of financial services. However, the impact of fintech on infrastructure – what IJGlobal dubs infrafintech – has been one of the weakest links. It’s time for that torpid state to change. Fortunately, green shoots are appearing on the horizon. Some are already under your feet.

*** Complete this contact form if you are interested in hearing about IJGlobal's next steps to continue the market conversation. ***

Problems? What problems?

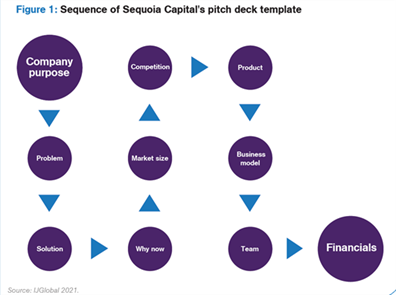

Today’s infrafintech entrepreneurs have easy access to legendary startup pitch decks. Venture capital firm Sequoia Capital tells you straight up what they’re looking for in their deck template. (See Fig 1.)

“A core problem with infrastructure is that the failure rate – that is projects under development that don’t reach financial close – can be as high as 80, even 85%,” says Giridhar Srinivasan, chief executive of Infraclear, a Washington-DC-headquartered startup. “But the problems don’t stop there. The asset’s life is often riddled with operational and management challenges.”

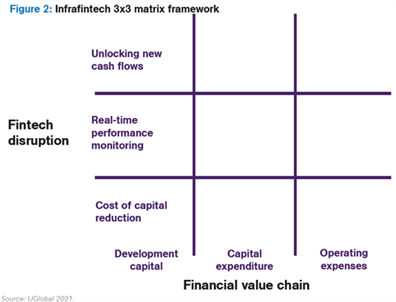

A 3x3 matrix aids Peter Adriaens, director of the Center for Smart Infrastructure Finance, to frame the challenges and innovate solutions with its industry collaborators, including Ripple, Nuveen, and WSP. (See Fig 2.)

“Fintech’s first access point in construction to a large extent has been in opex,” says the University of Michigan professor of environmental engineering, finance and entrepreneurship.

Asian Infrastructure Investment Bank (AIIB) principal investment officer Stefen Shin (pictured left) backs up this claim. “We’ve had a lot more discussions about infratech compared with fintech’s applications in infrastructure financing,” says the Beijing-based banker.

“The infratech solutions we’ve seen tend to focus on smart ways to operate and manage assets – like the ability to adjust solar panels to account for the time of day and seasonal changes in the sun’s path across the sky.”

Perhaps the construction industry has responded constructively to Imagining Construction’s Digital Future – a June 2016 article by Rajat Agarwal, Shankar Chandrasekaran, and Mukund Sridhar from McKinsey.

The Asia-based McKinsey partners at the time noted that large projects normally took 20% longer to complete than scheduled and were up to 80% over budget. Financial returns of EPCs were often relatively low and volatile. The trio showed that the construction industry was one of the least digitised. Among 22 sectors, it was second to last, just beating agriculture and hunting.

Interestingly, the finance-and-insurance sector was the fourth most digitised. Yet the sector’s indisputable digitisation has had a conspicuous bald patch – the nexus between fintech and infrastructure finance… or infrafintech.

“In bigger infrastructure projects we are now limited to traditional methods. Volume of transactions, regulation, and political risk are barriers to entry for new ways of doing business,” offers Neilson of Allen & Overy.

Infrastructure asset tokenisation gives the right to access the value and performance, through a blockchain solution, of infrastructure sponsor or funds’ equity, private equity of the SPV owning the concession, or loans and bonds issued by sponsors. Gaps persist between the innovative asset classes and business models inspired by tokenisation and existing regulatory frameworks.

Another challenge for infrafintech’s adoption in Asia’s project finance market is that there’s more money than there are good projects. “In a highly competitive market like that, how does fintech move into the space?” asks Neilson. “Is infra finance a low hanging fruit or would it be better to concentrate on other areas first like consumer or SME finance?”

Adriaens underscores: “The biggest value proposition will be in fintech’s ability to facilitate the delivery of development capital and capex, which is always the hardest to get. Eighty percent of projects die on the vine and never reach financial closure. The opportunity is how to open the funnel to make projects bankable.”

Solutions addressing the financial value chain

At a macro level, thought leaders continue to advocate for governments, sponsors, lenders, EPCs and advisers to move away from standalone projects. They argue for enhanced integration of the development, construction, and management of complementary assets. The industry should habituate packaging electricity, water, and whatever the third asset is into a single project, the insiders argue.

“Asset tokenisation is a strong contender to finance infrastructure in the future,” says the Center for Smart Infrastructure Finance’s Adriaens (pictured right). “Data are not beholden to siloed assets like we’ve conceived in the past. Bundling these different data assets so that they are not stove-piped is crucial. Finland has excelled at this integration.”

No one questions the importance of integration in transport.

“Beyond O&M improvements, another area is making infrastructure more user friendly. Connectivity plays a large role in our Infrastructure for Tomorrow strategy,” adds Shin of AIIB. “A goal is to make the transition from one mode of transport to another as seamless as possible. Smart technologies are increasingly being used in the field to improve the commuter or traveller’s experience.”

The use of the same project finance law firms, banks, and advisers with roughly the same templates has yet to translate into a significant reduction in failure to reach financial close or (when transactions close) the time to closure has yet to accelerate appreciably.

Some solution providers are focusing on project agreements.

“Every time I told technologists that I wanted to gather thousands of publicly available loan and concession agreements and use natural language processing to extract data on top of it,” recalls Infraclear’s Srinivasan (pictured left), “they all asked, startled, ‘What … that’s not been done before? That’s not too crazy to do’.”

He adds: “NLP is well suited to finding hidden value in the supposed cacophony of agreements. Even though the agreements may not be standarised in the truest sense, they are harmonised.”

Law firms, as controllers of the agreements, have a unique role to play.

“Legaltech intersects with fintech to a certain degree,” says Neilson, who heads A&O’s banking and finance team in Asia Pacific. “We are working to smooth our clients’ documentation management processes as they negotiate and execute the project finance loans. These efficiency gains can particularly enhance smaller projects, like renewables, where you stick with the solar developer as they build up their portfolio.”

The law firm’s innovation incubator Fuse has a range of companies that may bolster infrafintech, including building custom, closed marketplaces for banks and fund managers to trade the securities of real assets.

State Street Alpha for Private Markets solution will be an incumbent's counterattack. The launch will follow the anticipated close in September of Charles River Development's acquisition of private markets front-and-middle office platform Mercatus.

Solution providers are also attempting to convert real assets to digital assets. They then connect the data streams to the actual P&L of the asset.

“Connecting the digital twin to the P&L of the project finance or project companies is on the top of everyone’s wish list. It’s the Holy Grail to crack that nut,” offers Adriaens.

Incumbent and disruptive telcos are also a factor in infrafintech’s development. They are becoming involved in smart infrastructure. Some are consuming data from the infrastructure assets and not just gaining insights but taking it down to a popular Ethereum token called ERC-20. The telcos are forward integrating and unlocking value.

Infrafintech’s role in securitisation

Infrastructure asset-backed securities (IABS) are a part of the industry’s landscape where infrafintech may bear its most valuable fruit.

“You are right to point to the securitisation type model,” shares Neilson. “We have explored those models with clients. You could securitise anything within reason with coins for instance. Take EPC contractors. You could securitise the revenue streams under those EPC contracts and issue a coin offering.”

Before the advent of residential- and commercial-mortgage-backed securities, the real estate industry exhibited many of the same obstacles hobbling infrastructure’s ability to recycle capital.

In the US market, the difference between the pre- and post-securitisation era is crystalised by the reduction of the myriad of loan types to the simple bifurcation of conforming and nonconforming loans. These loans align with the financing limits set by Federal Housing Finance Agency and meet underwriting guidelines established by Fannie Mae and Freddie Mac.

“Just before real estate was securitised, there was a hodgepodge of loans. As soon as RMBS and CMBS gained traction, there was a powerful financial incentive to securitise,” argues Srinivasan. “We envision fintech allowing IABS also to take off.”

A project banker reflects: “Securitisation is not vanilla financing. By itself, securitisation is a technology or technique linking the loan and securities markets, enhanced by diversification. Perhaps AI’s use of Big Data might someday match an investor’s optimal risk-return profile to a specific tranche in a securitisation issuance.”

“In Asia, there’s not a lot of trading of infrastructure loans,” offers Neilson. “The project finance banks, multilaterals, and ECAs tend to hold the loans and the commercial banks make money from hedging services and the like.”

He points out the healthy – but not huge – market in France of ECA backed-project loan securitisation. “Yet in Asia the secondary market is more plain vanilla.”

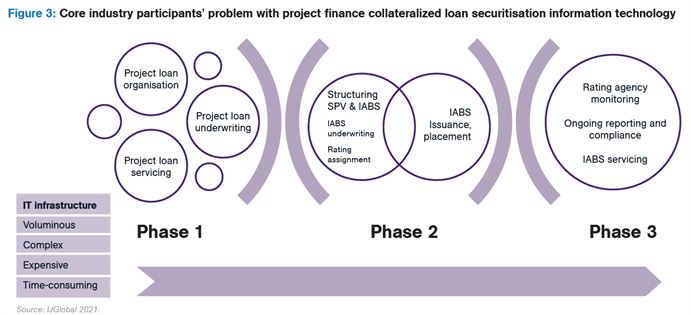

Infrafintech founders may solve problems in one or more of securitisation’s three phases. (See Fig 3.)

An IABS industry of the future may broadly delimit phase 1 with only project finance loans that have reached financial close. Phase 2 would draw from that opportunity set and structure the IABS. Post-issuance, or phase 3, would involve rating agency monitoring, and administration and trustee services.

“If the opportunity set of assets and project loans could include 500 assets, then AI’s value proposition only grows. The trade-off is that while the average loan size in the securitisation would likely fall, the administrative and servicing costs would rise. Here, evaluating and adapting technology in microfinance may be useful,” notes a banker.

Fintech platforms focused on digital securitisation have already gained regulatory approval to issue and sell digital assets and securities to investors. Some are positioned to facilitate IABS and insurance-linked securities, general- and limited-partnership structures, and capital raising by startups. These platforms are likely to dislocate administration and trustee services.

A banker considers that AI and infrafintech would have a “huge impact” on the IABS market after the issuance. A private blockchain would be used in a closed group of investors and post-issuance administrator. The blockchain would enable a more reliable view into the project company’s account.

“Blockchain would also allow investors more direct access to a project’s operational performance, if say we had the ability to view data about how much electricity a dam is producing on a week-by-week basis,” says the market insider. “Reporting for impact would also get a big boost.”

Neilson cautions: “When there’s talk about bringing a securitisation to market more quickly, you need to compress not only the time for due diligence but also the negotiation phase. The human element will always be there … no matter how much you can speed up using tech, you still need to negotiate the commercial structure and terms. Multiple parties are always involved, and regulatory issues can be complex. Not everything can be solved by the tech.”

Bayfront Infrastructure Management chief executive Premod Thomas (pictured right) told IJGlobal the day of Bayfront’s $401.2 million IABS issuance: “The received wisdom is that project financing is clunky, bespoke and highly structured. We are taking a different view. Onboarding assets can be quicker. On the distribution side, we are having interesting conversations with exchanges about tokenisation. Issuing asset-backed securities tokens is on people’s minds.”

A call to action – Get in touch to learn more

Successful infrafintech platforms will adapt to the varied – sometimes competing, often complementary – interests of actors in the infrastructure finance market.

“In some systems there could be resistance to the model. Incumbent companies might not like the dislocation because they are selling a service that the new upstart is trying to disrupt. They don’t want to be disintermediated out of that process,” Neilson notes.

The compressed margins in project finance are spurring self-interested bankers to take a keen eye to infrafintech.

“Project finance is a part of the bank that is suffering,” offers Srinivasan. “Bankers need a faster, more data-driven way to get deals done. We’re a lifeboat for project finance.”

Infrafintech entrepreneurs are attempting to innovate the crossroads between the financial value chain and reducing capital charges, improving real-time performance monitoring, and unlocking new cash flows.

Securitisation is the arena where founders and their teams may discover the most meddlesome customer pain points. Hence the structuring, issuance, and servicing of IABS are microcosms of the larger infrafintech puzzle.

“We are very interested to hear more about fintech projects in infra finance,” says Neilson. “Everyone wants more efficiency, reduce people hours devoted to tasks better automated and decreased risks.”

Complete this contact form if you are interested in hearing about IJGlobal's next steps to continue the market conversation.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.