Privatisations remain airborne in Brazil

In November (2018), the Brazilian government announced the launch of its 5th round of airport privatisations, which are to be granted in 2019. The drive to bring private capital into the state-dominated airport sector has been constant in recent years, despite political volatility that has slowed down the process.

The country’s airports currently operate beyond their capacity. For example, Guarulhos, Sao Paulo’s primary international airport, was designed for nearly 29 million passengers, but handled 39 million passengers in 2018.

This over-crowding has affected airports across the country. The situation was even graver back in 2011 when air traffic was booming in the foreglow of the 2014 FIFA World Cup and the 2016 Summer Olympics. Indeed, at the turn of the decade air traffic had grown more than 170% to 87.9 million passengers in 2011, from a low of 32.4 million passengers in 2003, according to World Bank data.

In order to meet rising demand, Brazil launched its airport concessions programme in 2011 with the tender of Sao Goncalo do Amarante Airport. A 2012 concession round followed, involving the Guarulhos, Viracopos and Brasilia international airports.

The bids submitted surpassed the government’s expectations, collectively totalling R$24.5 billion ($14.3 billion) as compared to the meagre R$5.4 billion minimum target set by the government.

Another two rounds of auctions ensued. 2013 marked the concessions of Rio de Janeiro-Galeao International Airport and Tancredo Neves International Airport (Confins), while Salvador, Florianopolis, Fortaleza and Porto Alegre followed down the same path four years later (2017).

However, air traffic tailed off in 2015, as the country faced both economic recession and a stark political crisis. Passenger traffic peaked at 102 million in 2015 before falling 7.7% to 94.1 million in 2016, according to the World Bank.

At this point, many of the concessionaires had invested heavily in expanding and ameliorating the airports’ infrastructure, as expected by the Brazilian government, which remained a stakeholder in the airports.

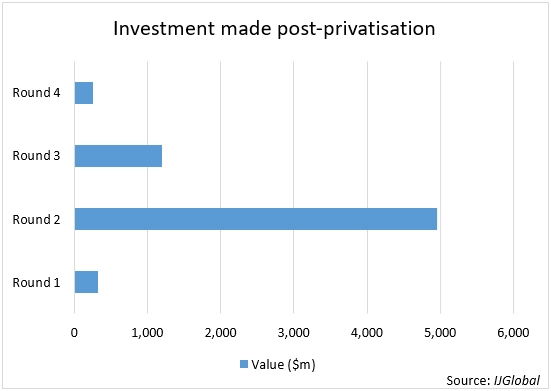

IJGlobal data show an overall investment of roughly $7 billion after the privatisations, with an all-time high concessionaires’ commitment in Round 2, prior to the Rio Olympics.

However, the slump in passenger traffic led to the accumulation of debt by the private parties. As a result ANAC (National Civil Aviation Agency of Brazil) sought to restructure payments for the Brasilia and Sao Paulo Guarulhos concessions, while in July 2017 the investors in Viracopos airport voted to return the airport to the regulator after sustaining significant financial losses.

To make things worse, national airport authority Infraero, which holds a 49% share in all concessions, started falling behind on its payment obligations. In December 2018, newly elected President Bolsonaro outlined his plans to terminate Infraero and have all airports privatised entirely in the coming years.

The forthcoming privatisation round in 2019 could be an important milestone in the President’s agenda. It will include 12 airports, organised as regional clusters, where a profitable capital city airport is being grouped with underperforming regional airports in need of investment to become profitable.

Concession plans include the expansion, maintenance and exploration of the infrastructure. The new concessions to the private initiative will have a term of between 25 and 30 years. The estimated investments with the concession of the 13 airports is R$3.52 billion ($947 million).

| North east block | South east block | Mid west block |

| Maceió – Alagoas state | Vitória – Espírito Santo state | Alta Floresta – Mato Grosso state |

| Juazeiro do Norte – Ceará state | Macaé – Rio de Janeiro state | Cuiabá – Mato Grosso state |

| Campina Grande – Paraíba state | Rondonópolis – Mato Grosso state | |

| João Pessoa – Paraíba state | Sinop – Mato Grosso state | |

| Recife – Pernambuco state | ||

| Aracaju – Sergipe state |

President Bolsonaro is reported to be drafting plans for the concession of six additional regional blocks of airports, 44 in total, to be awarded by 2022.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.