US and China – first responders

The US Senate on 3 October (2018) passed the Better Utilization of Investments Leading to Development (BUILD) Act. It aims to facilitate the investment of $60 billion in developing countries through a newly formed development finance agency – the US International Development Finance Corporation (USIDFC).

It’s an ambitious target spurred on by the US government’s desire to counter China’s large and growing influence in emerging markets, bought through significant investment in development projects over recent years. President Donald Trump signed the BUILD Act only two days later on 5 October.

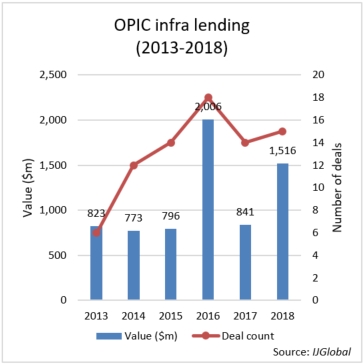

The USIDFC will incorporate the Overseas Private Investment Corporation (OPIC), which has so far been the US’ main institution for providing overseas development loans. Contrary to OPIC’s current practice, the new agency will invest equity in projects – something contemporary financial institutions, from China and elsewhere, already do.

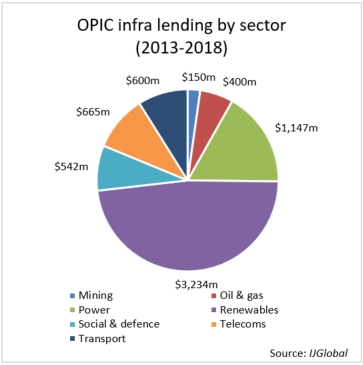

OPIC has predominately lent to the renewables sector over the last five years, according to IJGlobal data. It has provided over $3.2 billion – almost half of all of its lending – to 48 projects over that period. Meanwhile, the power sector was the second biggest recipient of OPIC debt, comprising roughly $1.15 billion – with all other sectors receiving far less in funding.

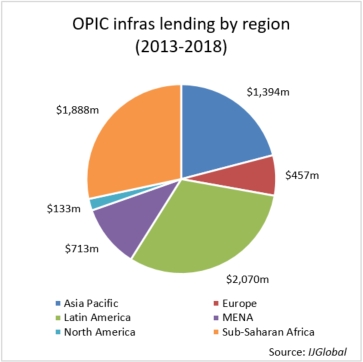

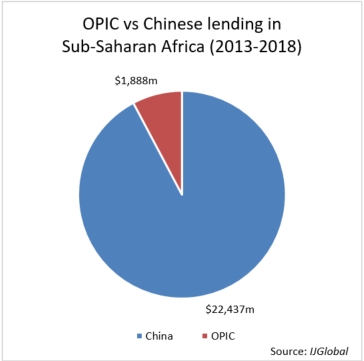

According to IJGlobal data, OPIC has concentrated its infrastructure lending in Sub-Saharan Africa and Latin America. Between 2013 and 2018, the development finance agency disbursed almost $1.9 billion in debt for 28 projects in Sub-Saharan Africa and over $2 billion across 22 projects in Latin America.

Comparatively, Chinese state-owned banks and institutions provided around $22.4 billion in debt to infrastructure projects in Sub-Saharan Africa and participated in 50 deals in the period of 2013 to 2018.

These Chinese lenders include:

- Bank of China

- Central Bank of China

- China Construction Bank

- China Development Bank

- China Exim Bank – contributed roughly 3/4 of the debt

- government of China

- Industrial and Commercial Bank of China

- International Commercial Bank of China

IJGlobal data shows that Chinese loans in Sub-Saharan Africa's power sector over the period totalled over $13.9 billion, compared to OPIC’s $695 million. The US development bank, however, was more active in the renewables sector, providing over $1.2 billion debt compared to $374 million from the Chinese institutions.

Among the large renewables projects in Africa supported by OPIC are the 310MW Lake Turkana wind farm in Kenya and, more recently, the 158MW Taiba N’Diaye wind farm in Senegal.

USIDFC is likely to remain a significant lender in Sub-Saharan Africa and Latin America, but other regions may also benefit from the BUILD Act. OPIC loans have declined in Asia Pacific over the past two years – from $936 million in 2016 to around $60 million in 2017, and with no loans to date in 2018.

USIDFC’s budget of $60 billion will more than double the lending cap of OPIC. With China committing $60 billion of investment into Africa alone in September of this year (2018), development funds should not be in short supply over the next few years.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.