Pakistan’s power potential

Pakistan, a country where over 140 million people don’t have access to power, is investing heavily in its energy sector. And Asian investors are taking advantage.

Chinese companies are one of the most active investors in Pakistan’s power sector. In the last few months State Grid of China said that it will help build a 4,000MW power transmission line in Pakistan in a project valued at $1.5 billion. And in April China’s Shanghai Electric acquired a majority stake in Pakistani electricity company K-Electric for $1.8 billion.

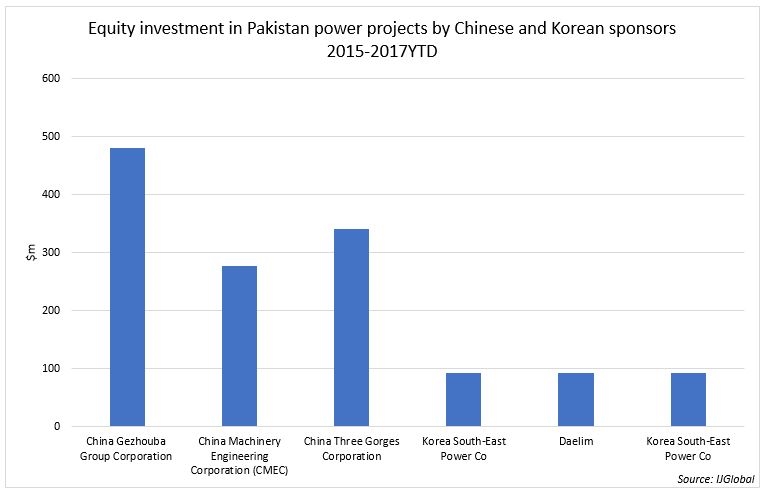

According to IJGlobal data, Chinese companies have invested $3.4 billion in Pakistani power plants - as either a lender or sponsor to the project – since 2015. Korean investors have also shown a penchant for power in Pakistan with sponsors investing around $275 million in projects since 2015.

The potential for power investment in Pakistan is huge. There is expected to be significant Chinese investment in the next year as a result of the China Pakistan Economic Corridor (CPEC) project; a collection of infrastructure projects in Pakistan valued around $54 billion. And with over 10,000MW of planned power development in procurement the opportunity for investors is sizeable. It is understood that Chinese investors are expected to invest in four wind power projects, three hydro power projects and one solar power project along with a 660 KV transmission line between Sindh and Punjab. In mid-March Pakistan’s Secretary Water and Power, Mohammad Younis, said that Chinese companies will be investing $35 billion in 19 power projects which will generate a further 12,134MW.

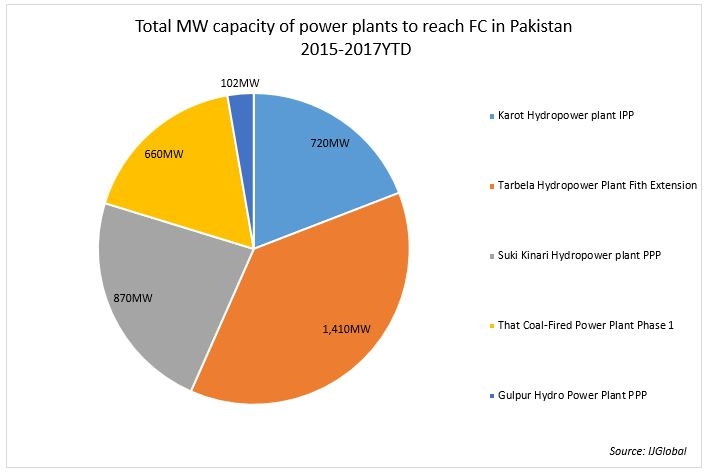

A number of major hydro and coal-fired power plants in procurement are expected to reach financial close between now and 2019. These include the Jamshoro Coal-Fired Power Plant Expansion (1,200MW), for which the Asian Development Bank (ADB) has approved a $900 million loan, and the Dasu hydropower project, which recently saw a local bank-led consortium lend to the project.

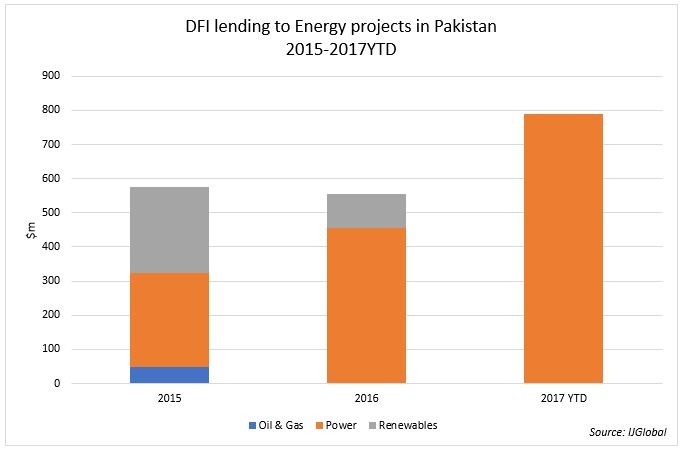

Financing for Pakistani power projects is largely the domain of local Pakistani banks, international and Chinese development banks. According to IJGlobal data DFIs have lent around $19 billion to energy projects in Pakistan since 2015. The majority of this has been in the power sector.

Since early 2015 five new power projects have reached financial close in Pakistan, with a total generating capacity of around 3,762MW. The majority of the debt providers for these projects have been DFIs and local banks, including the World Bank, the Asian Infrastructure Investment Bank (AIIB) and the International Finance Corporation (IFC), and Pakistani banks such as Habib Bank and Meezan Bank.

Pakistan has faced severe power outages in recent years and a lack of reliable energy to its industry has been a major factor in the government attempting to bring in foreign investment and expertise in the country’s power sector. The drive is likely to continue for some time.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.