REIPPP stumbles on round four

South Africa’s renewable energy independent power producer procurement (REIPPP) programme has stumbled at its fourth round, with no power purchase agreements signed or projects financed. Problems ranging from a weaker currency to arguments over the need for baseload have slowed its progress.

The country’s Department of Energy (DOE) selected 13 preferred bidders for round four in April 2015 and a further 13 in June of the same year, but so far none have reached financial close. South Africa’s Department of Energy had previously planned financial close for the fourth quarter of 2015.

South Africa needs to bring new capacity online to stem serious power shortages which are hampering the country’s economic growth. Power cuts are the country’s greatest challenge and have reduced growth by 1%, President Jacob Zuma said in August 2015.

State utility and procurer of the REIPPP projects, Eskom, was forced to use load shedding last year in efforts to reduce power use as demand exceeded generation. But despite the pressure on the grid, the utility said earlier this year that it wouldn’t finance new projects until it has had further consultations with the government, group executive Matshela Koko said in July.

The utility is compelled by the government to buy electricity from the independent power producers at prices it does not negotiate, leading to concerns that its revenue streams will suffer in the long run, he said at the time. Koko wants the government to change focus and invest in nuclear power to provide baseload capacity for the country.

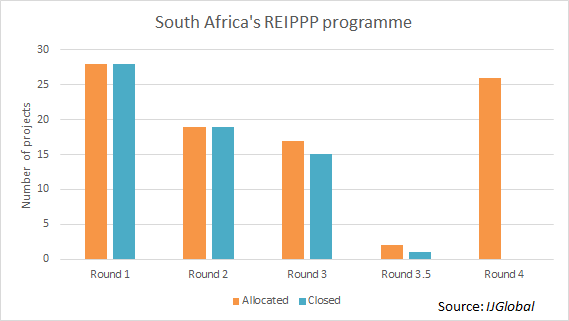

That’s not to say that the previous rounds weren’t ultimately successful, or without teething problems; round one saw 28 projects awarded preferred bidder status in December 2011. All 28 went on to reach financial close on the same day – albeit in November 2012, almost six months after the planned closing date. Regardless, procuring such a high number of wind and solar projects in a short space is a noteworthy achievement for the programme. Its predecessor, the renewable energy feed-in tariff regime, failed to procure a single project over the two years it was active.

Round two saw 19 preferred bidders awarded in May 2012. They reached financial close six months later than expected, in May 2013. Round three saw something of a slow down after 17 preferred bidders were chosen in October 2013, of which 15 reached signed financing in December 2014 and closed the following January – after the initially planned date of end-July 2014. Eskom had planned to roll the REIPPP rounds out at a rate of one-per-year, but grid connection delays affecting round three meant the fourth round wasn’t launched until mid-2014.

An expansion to the third round – round 3.5 – aimed to procure concentrated solar power capacity and awarded Engie (known at the time as GDF Suez) and Acwa Power a 100MW project each in late 2014.

Engie’s Kathu project reached financial close in June this year but Acwa’s Redstone project has stalled due to disputes regarding the project’s tariff price. The rand’s weakness against the dollar has meant the proposed 20-year PPA – worth R50 billion ($34.8 million) in June 2016 – has risen in cost to R62 billion.

As a result Eskom last month delayed signing the PPA with Acwa Power “until further notice”. The project has a signing window in place for the end of October 2016, a banking source told IJGlobal, although a source at Acwa commented that “nothing is clear on Redstone at this stage”.

Round four initially saw 13 projects awarded in April 2015 before the DOE announced extra allocations through an additional tender round – 4.5. A further 13 wind and solar projects were awarded under round 4.5 in June 2015 before Eskom then announced a further 1,800MW of new capacity to be made available under its ‘expedited’ renewables bidding round. The expedited bid round aims to further address power capacity shortages. It gives previously unsuccessful bidders the chance to win mandates for projects that can be ready “within the required time-lines, including projects which were unsuccessful in previous bid submission phases," the DOE said.

Despite the ambitious amount of capacity under procurement, a date for signing of power purchase agreements is “to be confirmed” by the DOE, according to its website – over 18 months since the initial 13 round 4 projects were awarded. In comparison, rounds 1 to 3 had gone from awarding of preferred bidders to financial close within 13 months at most.

If the round four and expedited projects do successfully close, the REIPPP programme will have added around 7,085MW of renewables capacity to the grid. A request for proposals release for the fifth round is planned for the second quarter of 2016.

(*The image attached to this article shows the 88MW Nojoli wind farm in South Africa, courtesy of Enel Green Power)

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.