Dubai’s determined renewables drive

The Dubai Electricity and Water Authority (DEWA) recently unveiled a five-part strategy aiming to cut carbon emissions by 16% by 2020, adding to its existing target of a 75% share of renewable energy by 2050. The utility’s new targets are inspired by a renewable energy procurement programme which has been progressing well.

DEWA’s near-term targets include pushing renewable generation as a portion of its overall energy mix to 7% by 2020 and 25% by 2030 – vastly multiplying its ambitions for targets previously set at 1% and 5% over the same time periods.

Active renewable opportunities

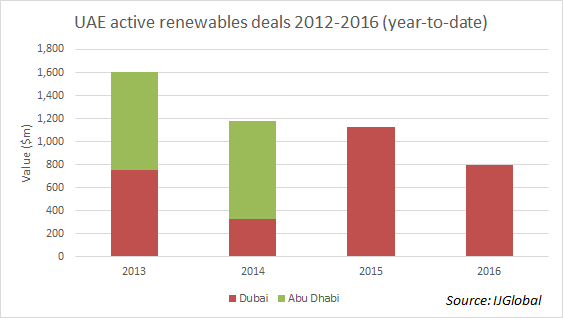

IJGlobal data shows that only one project, the $800 million third pahse of the Rashid al Maktoum solar park, is in procurement in the UAE as of 9 September 2016. This is the largest solar project in the UAE to date however, and a number of smaller deals have been procured in the country in recent years.

The Dubai government plans to eventually expand the Rashid al Maktoum solar complex to 5,000MW of mixed photovoltaic (PV) and concentrated solar power (CSP) generating capacity. DEWA awarded its 800MW third phase to a consortium of Fotowatio Renewable Ventures (FRV’s), Masdar and Abdul Latif Jameel in May 2016. A 200MW CSP stage of the park is planned for tender in 2017, with DEWA selecting winners for its advisory tender last month.

FRV’s consortium bid $0.0299 per kWh, which at the time was the lowest tariff price awarded for solar power in the world. The second phase of the project had previously set a record price of $0.0598 per kWh. Dubai's tariff prices have since been surpassed by Solarpack’s bid of $0.0291 last month for the 120MW Granja solar project in Chile.

Potentially inspired by the low cost energy its neighbour was capably procuring, Abu Dhabi has its own designs on utility-scale solar projects. The Abu Dhabi Water and Electricity Authority is tendering for 350MW of solar PV at Sweihan, IJGlobal exclusively revealed last September. Bidding consortia vying for the project began forming in June 2016 though the project does not yet have an expected value and as such isn’t included in the active project data. In addition, the UAE’s overarching Federal Electricity and Waste Authority announced plans earlier this week to develop a 200MW solar plant, although it didn’t disclose where it will be located.

Can DEWA beat its 2020 target?

DEWA expects to reach 10,356MW of installed capacity by 2018 once a 700MW combined-cycle power plant expansion to the 2,060MW M-station independent water and power producer is brought online, according to its website. The first 600MW of the 2,400MW Hassyan coal-fired power plant is expected online by 2020, with the remaining capacity coming online through to 2023.

With the second and third phases of Rashid al Maktoum expected online by 2017 and 2020, respectively, that will mean Dubai has 1,013MW of utility scale solar capacity (including the 13MW first phase) online in 2020 as part of its 10,956MW total. A further 60MW in capacity is expected in 2020 from the Al Warsan 2 waste-to-energy plant, announced earlier this year. With renewables potentially representing almost 9.8% of the utility’s energy mix, it looks as though the utility could capably beat its 7% target for 2020.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.