The art of arranging

Commercial banks are often judged by the total value of debt provided to clients over a specific period. During a time of restricted balance sheets and increased regulation however, it may be worth considering other ways to measure performance.

The role of mandated lead arranger (MLAs) requires a bank to assist in the structuring of debt and attract other lenders into the transaction. The more favourable terms it can negotiate with the sponsor of a project, in theory, the greater competition from other lenders to participate in the deal. If demand is high from other lenders, the MLAs will not need to provide large tickets to ensure the total debt requirement is met.

On this basis, the average percentage of total debt provided by an MLA on the transactions they participated in, should give you an indication of performance. Not the definitive performance metric perhaps, but an interesting one nevertheless.

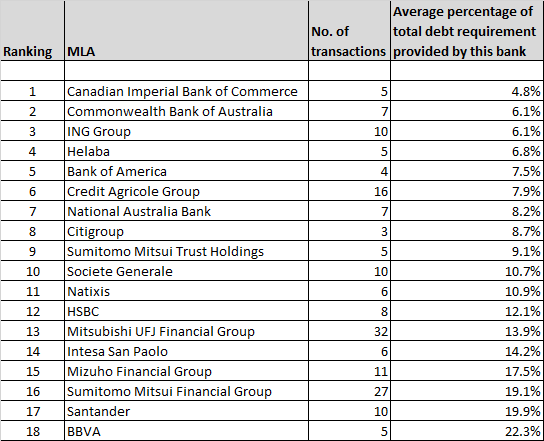

With this in mind, IJGlobal took a look at the arranging performance of the most active global MLAs for the first quarter of 2016. We ranked MLAs based on the average percentage of total debt they provided on the transactions they participated as lenders on.

The data these results are based on is provisional and incomplete; the IJGlobal League Tables for Q1 2016 will not be published in full until later this month and our analysts are still busy processing submissions. But the rankings still provide food for thought.

The table only includes the top 15% of MLAs based on total debt provided during the quarter. And so lenders which on average took the smallest debt tickets but also only provided a small total value of debt during the quarter are excluded. The data is also only based on project finance transactions, with all corporate facilities stripped out of the results.

The top ranking bank is Canada’s CIBC based on their lending on five transactions, spread across the US, Australia and the UK. Based on our provisional Q1 results, the bank is outside the top 15 of global commercial lenders for total lending. But the bank has only participated as part of large bank clubs on its five deals, allowing it to reduce its proportionate exposure.

More revealing perhaps is how the more active lenders compare. ING and Credit Agricole participated in 10 and 16 transactions, respectively, but on average took less than 8% of the total debt requirement for those deals. Mizuho in comparison lent on 11 deals and provided 17.5% of the total debt required for those transactions.

The two most active banks in the sector, Japan’s MUFG and SMBC, on average take sizable tickets on the deals they participate in. This may seem unsurprising, as it has been the strategy of Japanese banks to heavily invest abroad for a number of years. So there is less commercial pressure to reduce lending volumes per deal than there may be for European banks with more constrained balance sheets.

Some may argue however that this demonstrates how these institutions have bought deals in highly competitive markets, by providing pricing and terms unpalatable to other lenders.

More surprising perhaps is the placing of Spain’s Santander and BBVA at the bottom of our list. BBVA in particular has taken very large tickets on the five deals it has lent on during the first quarter. How that reflects on its abilities as an arranger, I will leave our readers to decide.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.