Latest Analysis

FAA bill revision – a game changer for US airports?

Transport North AmericaThe airports sector in the US has both fascinated and frustrated the private sector given the huge potential for investment. But in the last month, the Federal Aviation Administration’s reauthorization bill has made important revisions – including removing the cap on the number airports that can be leased and allowing the public sector to retain a stake in a potential project

Northwester 2 offshore wind, Belgium

Renewables EuropeAs Belgium looks ahead to the next round of offshore wind auctions scheduled for 2020, hoping to emulate Germany and the Netherlands by attracting zero-subsidy bids, a Japanese-Belgian consortium reached financial close on Northwester 2 – which could be one of the last subsidised offshore wind projects in Belgium

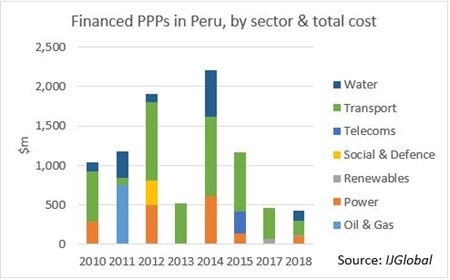

Powering down Peru's renewable energy auctions

Renewables Latin AmericaDespite being a steadily growing investment grade economy with a relatively stable currency and consolidated rule of law, Peru has in recent time not received as much attention from international energy developers and investors as some of its LatAm peers. This has much to do with the sense that Peru has overbuilt its power market

Turkey – unclogging the fan

Transport EuropeThe Turkish currency crisis is causing ripples around the international infrastructure finance community with all parties active in the nation reaching for project documentation to ensure they are not about to take a severe haircut

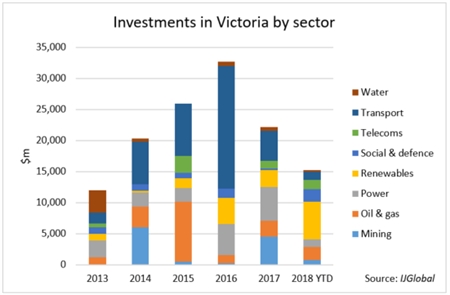

Policy shaping Australian renewables landscape

Renewables Asia PacificAustralia's National Energy Guarantee may have been abandoned by new prime minister Scott Morrison, but appetite for renewables investments in the country remains strong, especially among infrastructure funds

Acquisition of North Sea Midstream Partners, UK

Oil & Gas EuropeThe acquisition of North Sea Midstream Partners was a major win for Kuwait sovereign international investor Wren House Infrastructure Management, and followed a competitive auction process in which bidders leapt to pre-empt the binding offer deadline by around a week

EIB… something for the weekend?

Transport EuropeBack in the PPP pipeline days, you could set timing on the project finance of any old piece of European infrastructure by the tired mantra of lenders intoning: “And… yes… you can count on the EIB taking half the debt”

The Peruvian PPP push

Power Latin AmericaPeru is one of many countries around the world hoping to boost economic performance by closing its infrastructure gap

QIC: MaaS is the future

Transport Asia PacificAdopting Mobility as a Service requires infrastructure investors to see their assets as part of a more integrated system, QIC’s head of global infrastructure Ross Israel tells IJGlobal

Gordie Howe Bridge P3, Canada/US

Transport North AmericaThe Gordie Howe Bridge P3 – formerly known as Detroit River International Crossing (DRIC) and the New International Trade Crossing (NITC) – has been an endurance test. One of the largest ever infrastructure projects in North America, 18 years passed between completion of its cross-border traffic study and financial close on 28 September (2018)

Kenyan PPP: it’s now or never

Transport Sub-Saharan AfricaThe whole of the Kenyan PPP programme may hinge on the success of one road project which is edging towards naming a preferred bidder

Argentina's PPPs – potholes ahead

Transport Latin AmericaA poisonous cocktail of corruption scandals, rising inflation, high interest rates and declining investor confidence threatens Argentina’s roads programme, just as it was gaining momentum

PABs: favoured financing

Transport North AmericaWith a sizable chunk of funding still available to developers, private activity bonds look set to be the gift that keeps on giving despite the growing availability of private placements

Belt & Road block

Asia PacificOne of the key pillars of China’s Belt & Road initiative has run into what was once a hypothetical political risk – the possibility of regime change in the recipient country

Alto Maipo: good hydro, gone bad

Renewables Latin AmericaA second restructuring for the 531MW Alto Maipo has saved a hydro project which has faced engineering challenges, several delays, environmental opposition, and changes in equity

London-listed infra funds: trading at discounts

EuropeLondon-listed infrastructure funds have suffered periods of trading at discounts in 2018 – one dropped out of a trophy M&A auction, and various asset sales are predicted