Latest Analysis

Infra Dig – taking Infra Core+ into forestry…

Beyond Infra EuropeThis latest episode of Infra Dig takes the ever-expanding definition of infrastructure to new limits… forestry

Green Breeze acquisition, Romania

Renewables EuropeNala Renewables' acquisition of the Green Breeze wind project in Romania is an important step in the company's expansion in Central and Eastern Europe, a region that benefits from strong government support and offers attractive risk-adjusted returns in the renewables sector

Al Ajban Solar PV Plant, UAE

Renewables MENAThe UAE is making significant strides in its energy transition as well as in diversifying its renewable energy sources

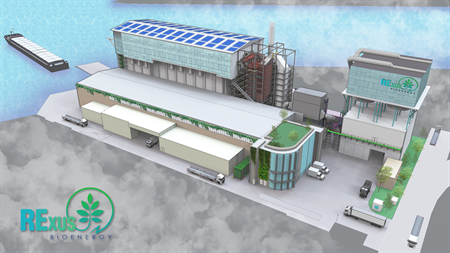

RExus WWtE project, Singapore

Renewables Asia PacificSingapore-headquartered developer Rexus Bioenergy has secured financing for a waste wood-to-energy project in Singapore

IJGlobal Podcast - Apterra, the New Kids on the Block

Oil & Gas North AmericaApterra, backed by New York-headquartered Apollo Asset Management, is no ordinary credit fund looking to put money to work, it is a direct origination platform designed to benefit all pools of capital

Infra Dig – Paraguay’s green fertiliser pathfinder

Renewables Latin AmericaAs IJGlobal ramps up marketing for the glorious IJLatAm conference in Miami next spring, the timing is perfect to focus on a pathfinder project finance transaction in Paraguay that looks set to be replicated across the globe

Infra Dig Masterclass – PF for peace & climate change

Renewables MENARavi Suri – global head of sustainable finance and impact investing at KPMG – once again joins the Infra Dig podcast for another Masterclass episode, this one focused on the role that project finance plays in achieving peace and climate change goals

Nuclear misstep for powering US data centres

Power North AmericaNuclear offtakes for data centre owners crashed into a hurdle when the Federal Energy Regulatory Commission rejected a request to increase nuclear power to an Amazon site

Budapest Airport, Hungary

Transport EuropeThe acquisition of Budapest Airport by the Hungarian state – via investment fund Corvinus – and Vinci Concessions marked not only Hungary’s largest deal of the year, but the “most high-profile M&A deal to have closed” in H1 2024 across Europe, according to IJGlobal’s own league table report

Thames Water – one lump, or two?

Water EuropeBattle continues to rage over Thames Water – the tarnished UK utility with questionable provenance and international ownership – to the extent you’d think it was a trophy asset

AIIF4: Africa’s Infrastructure Dynamics

Renewables Sub-Saharan AfricaRaising nearly $1 billion for its fourth infrastructure fund made African Infrastructure Investment Managers one of the largest private managers on the continent

Railpen, UK

Renewables EuropeUK pension fund Railpen, which has moved into direct infrastructure investing, may look to make larger allocations in future with investments outside the UK on the cards

US Presidential Election 2024: status quo or the sledgehammer

Renewables North AmericaThe biggest talking point among power sector executives in the build-up to the election has been the future of the Inflation Reduction Act. How each presidential candidate is expected to treat the IRA has been a point of consternation for the sector

ACWA nears launch of GH2 pilot, Uzbekistan

Renewables Asia PacificSaudi Arabia’s ACWA Power is approaching the commercial operations date for a green hydrogen production pilot project in Uzbekistan – set to become the first hydrogen project commissioned in Central Asia

Mogobe energy storage, South Africa

Renewables Sub-Saharan AfricaOngoing capacity shortages and load shedding have plagued South Africa for the best part of a decade. To tackle the issue, the South African Government has been utilising utility-scale IPP procurement programmes to bolster energy supply and encourage private sector participation

European PPP – a torpid waiting game

Transport EuropeSo, the UK’s going to have a PPP agenda, once again to lead the European market? Raise the flag and let’s have 3 cheers for the revival of a tried-and-tested infra procurement model. That flag will look like a relic from the Crimean War by the time we see the first financial close… if we even get that far