Latest Analysis

Offshore wind – floating an idea

Renewables EuropeIt’s a source of constant consternation for an observer of global infrastructure to watch as nascent technologies make the leap from emergent status to established/bankable in the blink of an eye… and that’s exactly what we see once again in the offshore wind space with floating turbines

Teknaf solar, Bangladesh

Renewables Asia PacificBangladesh’s first 15-year project financing – almost double the typical eight-year maximum tenor for the South Asian country’s infrastructure projects – crossed the finish line last week. GuarantCo played a crucial role in achieving the long tenor by mitigating payment default and liquidity risks on the $35.6 million Teknaf solar power project

Brooklyn Navy Yard cogen refi, US

Power North AmericaAxium Infrastructure completed the refinancing of the Brooklyn Navy Yard 286MW gas and oil-fired cogeneration facility in New York on 14 February using hybrid financing comprising tax-exempt bonds, taxable notes, and funds held under accounts created by the 1997 tax-exempt indenture

LNG-to-power in Brazil and GNA I

Oil & Gas Latin AmericaAn SPV comprising Prumo Logistics, BP and Siemens reached financial close at the end of March on the development, construction and operation of an LNG-to-power project located in the Brazilian state of Rio de Janeiro, part of a trend in the country's power market where there has been a surge of these types of projects

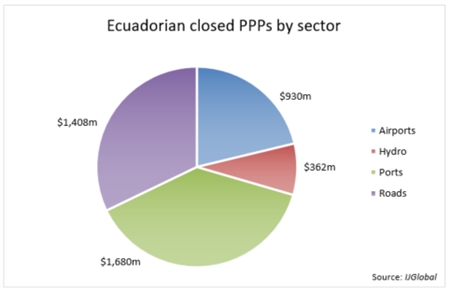

Ecuadorian PPPs – some progress

Transport Latin AmericaLatin America is increasingly looking at the PPP model as a way of facilitating private investment in new infrastructure. Ecuador is no exception to this trend

Rookery South Energy Recovery Facility, UK

Renewables EuropeAfter years of financial and environmental challenges, owners of the 60MW Rookery South Energy Recovery Facility at Rookery South Pit near Stewartby, Bedfordshire, brought the project to financial close

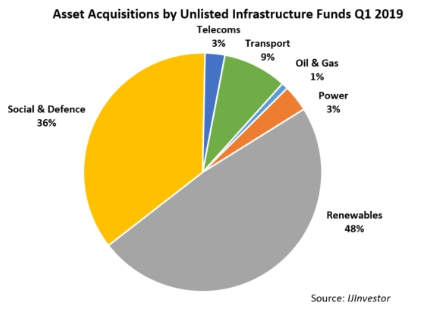

Fund focus switches from Asia Pacific to social infra

Oil & Gas Asia PacificAs eight unlisted, closed-ended infrastructure funds raised $20.6 billion at final close in the first quarter of 2019, some interesting trends have emerged from the IJInvestor Funds and Investors Q1 2019 report

Infra funds – pride before the fall

Renewables EuropeSince the beginning of time, the masses have been enthralled by building higher and bigger… a hubristic trait that usually ends badly and is repeatedly played out in the infrastructure funds space. This is why our quarterly report on fundraising by global infrastructure funds has so many in the industry predicting doom

Social housing bundle 1 PPP, Ireland

Social & Defence EuropeFinancial close on bundle 1 of Ireland's first social housing PPP project comes at a time of mounting pressure on the housing market, with a shortage of housing supply, an increased demand for home ownership and cases of half-built properties dotted across the country

Ethiopia’s REGREP on reality

Renewables Sub-Saharan AfricaEthiopia has seen three separate solar programmes reach significant milestones during the course of April – but a more important event last month was the emergence of the Renewable Energy Guarantee Programme that may lead to the East African state’s first ever utility-scale solar PV

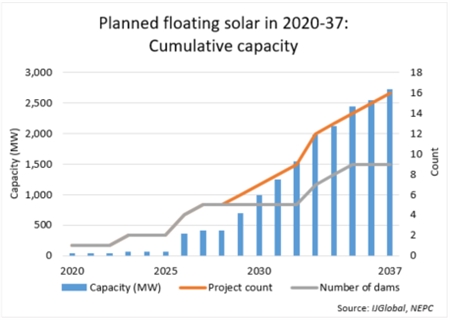

Thailand floats its energy strategy on solar

Renewables Asia PacificThailand's updated power development plan for 2018-37 reflects the country's ambition to embrace renewable energy, and features floating solar projects as a way to diversify the energy mix

Sharing “spillover tax revenue”: a revolution in infra

Renewables Asia PacificIndia’s new national broadband network could be the first project to enact an entirely new concession model, one which could revolutionise infrastructure finance

The great North American job hunt

Oil & Gas North AmericaFew things set tongues wagging faster in the infrastructure community than recruitment trends, bonuses and salaries. While most folk like to benchmark careers against their peer group – frequently sucking the wind out of many a sail – everyone wants to know who is going where

Rabigh-3 IWP, Saudi Arabia

Water MENASaudi Arabia’s Water & Electricity Company is looking to significantly build out desalination capacity in the country, and Rabigh-3 is the first in a pipeline of independent water projects it is currently procuring

Revolving doors whip up a storm

Renewables EuropeWith bonuses now having been trousered by many London infrastructure bankers, the resignation season is in full swing as people ready themselves for new challenges or ease into the salaried luxury of gardening leave

Fibre fiefdoms: here to stay?

Telecoms EuropeFibre-to-the-‘x’ deals – substitute x for premises, home or office – are increasingly visible in the M&A space, and in the last few weeks several deals have seen ambitious new players test the waters with some success