Latest Analysis

The future of CCS in Europe

Power EuropeIn the first week of November 2016 a group of 10 global oil and gas companies said they will commit $1 billion to help roll out commercial-scale low emissions technologies, of which its initial focus is carbon capture and storage

Washington, DC's PPP ambitions

Renewables North AmericaFor the first time since the signing of its Public-Private Partnership Act in December 2014, Washington, DC has unveiled a potential pipeline of infrastructure projects it wants to develop in partnership with the private sector

Iran’s oil ambitions take shape

Oil & Gas Asia PacificTehran’s plans to tender 50 oil and gas projects are taking shape with invitations to prequalify recently issued by the National Iranian Oil Company (NIOC). With the new Iranian petroleum contract (IPC), governing the terms of the deals, now approved by ministerial resolution, sponsors have better clarity on contractual requirements

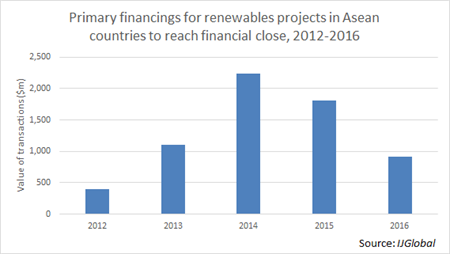

A decline in Asean renewables

Renewables Asia PacificFinancing volumes for greenfield renewables in the Asean region have dropped off significantly since 2014, mainly due to low input costs for conventional power plants

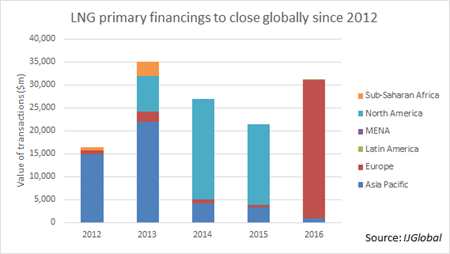

A glut of LNG export projects

Oil & Gas Asia PacificThe cost overrun figures quoted for Australian LNG projects this week were startling and additional costs are the last thing sponsors need given market conditions

Germany’s smart meters market heats up

Power EuropeThe upcoming sales of Techem and ISTA, the two dominant German smart metering providers for heat and water, could go for approaching €4 billion ($4.44 billion) each, and for both mandated financial advisers are already preparing to launch sale processes

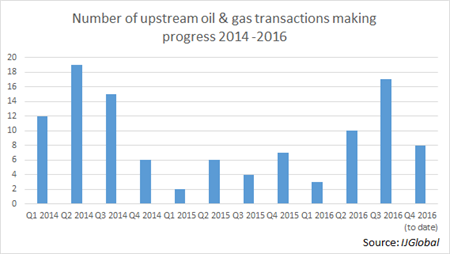

Data Analysis: North American upstream uptick

Oil & Gas North AmericaNot since 2014’s second and third quarter has the upstream space in North America seen such a surge in deals as during the second half of 2016 to date

Izmir Bayrakli Hospital PPP, Turkey

Social & Defence EuropeThe sponsors of Izmir Bayrakli Hospital closed on the project despite worsening economic conditions, managing to actually push out debt tenor lengths for its financing

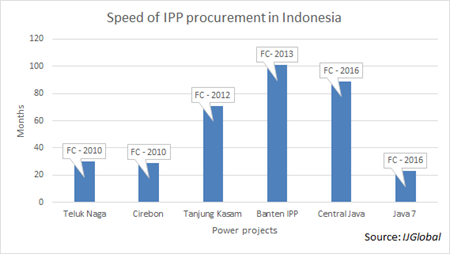

Indonesian procurement: signs of improvement?

Power Asia PacificWhen the 2,000MW Java 7 coal-fired power project reached financial close at the end of September 2016 it gave a major boost to the Indonesian power sector, which has seen a scarcity of completed transactions in recent years

Ausgrid Acquisition, Australia

Power Asia PacificAfter the surprise rejection of two Chinese bids for electricity transmission network Ausgrid, IFM Investors and AustralianSuper kept the deal on track by swooping in with an unsolicited proposal.

Q3 league tables: Winners and losers

EuropeIJGlobal looks at the performance of three companies it its Q3 league tables in order to highlight trends within the infrastructure finance market

Ontario's rail PPP push

Transport North AmericaInfrastructure Ontario and Metrolinx are seeking private sector sponsors for large portions of the planned expansion of the province's regional rail and light rail transit network

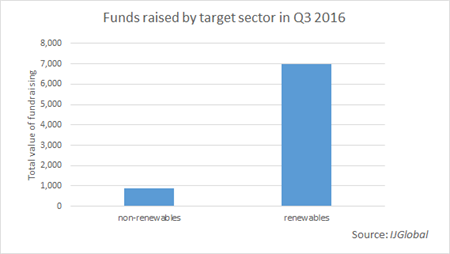

Data analysis: Renewables in focus for Q3 European fundraising

Oil & Gas EuropeOf the total funds raised in Europe in the third quarter of 2016 by unlisted, closed-ended vehicles, a vast majority is targeted at investments in renewable energy assets, IJGlobal data shows

REIPPP stumbles on round four

Renewables Sub-Saharan AfricaSouth Africa’s renewable energy independent power producer procurement (REIPPP) programme has stumbled at its fourth round, with no power purchase agreements signed or projects financed. Problems ranging from a weaker currency to arguments over the need for baseload have slowed its progress

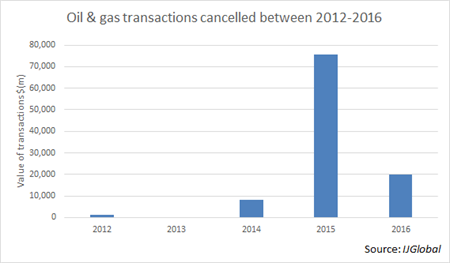

Oil rebound sparks investment hopes

Oil & Gas Asia PacificThe price of Brent crude oil rose to its highest level in a year earlier this week, raising hopes that investment levels in the beleaguered oil and gas sector could soon begin to rise

Acquisition of Thyssengas, Germany

Oil & Gas EuropeDutch fund manager DIF and the investment arm of French utility EDF have completed the acquisition of German gas transmission company Thyssengas from Macquarie, representing the first gas sector investment for DIF and the first in a potential second wave of gas transmission sales in Germany