Latest Analysis

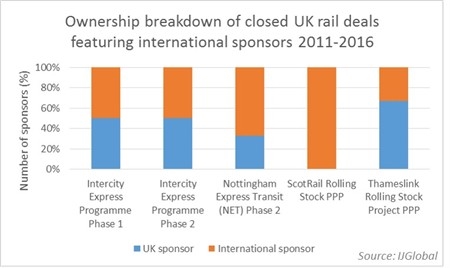

HS2 and the UK's procurement dilemma

Transport EuropeNationally significant infrastructure projects in the UK have often been subject to scrutiny if they do not provide business opportunities and jobs for UK companies

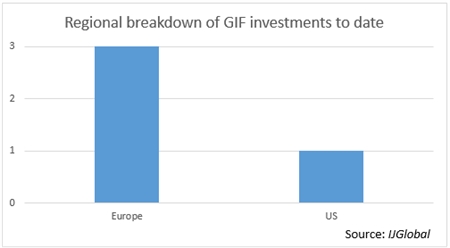

Fund analysis: AMP Capital global infrastructure platform

Oil & Gas EuropeOn 12 January 2017, AMP Capital announced the final close at $2.4 billion of its global infrastructure platform, which includes the AMP Capital Global Infrastructure Fund (GIF) and the relaunched Strategic Trust of Europe (SITE)

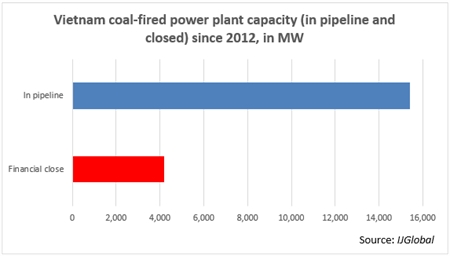

Vietnam: last chance for coal?

Power Asia PacificThe race is on to arrange financing for at least some of the 12 coal-fired power plants stuck in financing limbo in Vietnam, and many in the market fear that unless they can make progress in 2017, the projects will have to be abandoned

Interview: Google's Francois Sterin

Renewables Asia PacificIJGlobal met with Google's global infrastructure chief Francois Sterin to talk about how the company plans to meet its growing need for power

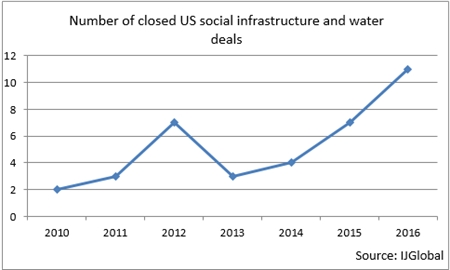

Data Analysis: Growth in US social and water deals

Social and water infrastructure transaction volumes have been on a gradual rise in the US, according to IJGlobal's financial close data for the sectors between 2010 and 2016

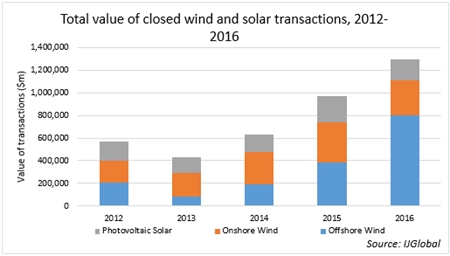

DONG Energy and offshore wind in Taiwan

Renewables Asia PacificTaiwan’s offshore wind energy industry in the last year has begun to see major investors and developments. This is occurring in the backdrop of the government releasing strong incentives and clear regulations for global investors and developers to follow

Interview: Mainstream's Bart Doyle

Renewables Latin AmericaMainstream Renewable Power was one of the first international developers to enter the Chilean renewables market in 2008, but it has been most active in the last 18 months

Canadian privatisations: a dangling carrot

Transport North AmericaThe Canadian government launched late last year two reviews to consider proposed privatisations of port and airport assets in the country. The privatisations could provide additional capital for new infrastructure in the country, but have met with opposition from Canada’s airport and port authority bosses

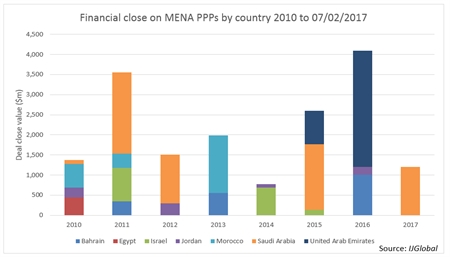

MENA PPP closes reach new heights

Oil & Gas MENAA record total value of PPPs reached financial close in Middle East and North Africa (MENA) region during 2016. With a number of large scale projects in the pipeline, 2017 could surpass this total

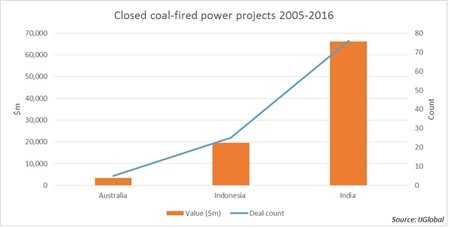

Multilaterals say no to coal

Power Asia PacificAs the world moves towards a low-carbon energy mix China’s Asian Infrastructure Investment Bank (AIIB) has announced that it will limit its investment in coal fired power projects. The move is representative of a global trend of multilateral development banks moving away from coal

Implications of a lost FERC quorum

Renewables North AmericaDrilling down on what the FERC can and cannot do without a quorum

The attractiveness of UK Student accommodation

Social & Defence EuropeUK student accommodation deals--both in terms of greenfield developments and portfolio acquisitions--have seen strong growth over the last two years, driven by robust demand and healthy investor interest. But with Brexit and saturation on the horizon, is this likely to continue?

Energy independence

Renewables EuropeAs major corporates become energy off-takers the energy market is shifting away from utility scale projects

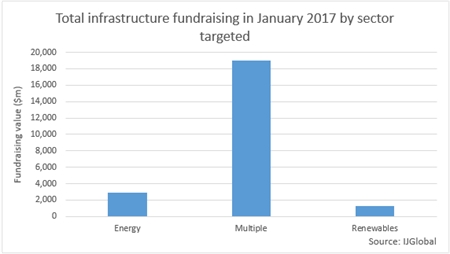

Data Analysis: Strong fundraising pace in 2017

Oil & Gas North AmericaThe final close of Global Infrastructure Partners III (GIP III) at $15.8 billion has pushed total funds raised globally in the first month of 2017 to some $23 billion

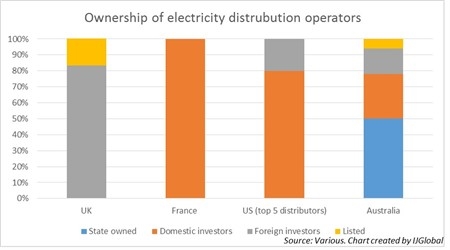

Who owns your electricity grid?

Power Asia PacificElectricity distribution assets are considered to be some of the most critical infrastructure in a country. Many developed markets have openly questioned the national security implications of foreign ownership of such infrastructure assets, particularly by Chinese investors

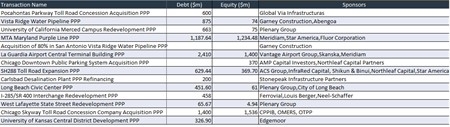

European equity leads US infrastructure investment

Transport North AmericaInternational investors including European, Australian and Canadian sponsors lead the equity investment in the majority of the deals that closed in 2016