Latest Analysis

Sunraysia solar, Australia

Renewables Asia PacificSome five months after financial close, project participants gathered for a ground-breaking ceremony this week at the 255MW Sunraysia solar farm near Balranald in New South Wales, Australia

Wales & Borders rolling stock, UK

Transport EuropeArriva's 15-year Wales and Borders franchise came to in October last year

Veja Mate Offshore Wind Farm, Germany

Renewables EuropeEarlier this month the first in a series of much anticipated German offshore wind acquisitions reached financial close. Sales of equity stakes in three other projects are expected to close this year following the sale of 80% of Veja Mate

Tłı̨chǫ All-Season Road P3, Canada

Transport North AmericaThe Tłı̨chǫ All-Season Road P3 project reached financial close in February. Despite being procured as a P3 with the typical DBFOM model, there are no banks involved, the private developers are providing a small percentage of the equity and a large chunk of the financing is being provided by the government

Infra fundraising – oops we did it again

Oil & Gas EuropeIt’s unseemly to crow about one’s victories in the heavily-contested area of data gathering on fundraising by unlisted, global infrastructure funds… but sadly, it’s also irresistible. Over the course of 2018, IJInvestor logged final close on $104 billion raised by funds – closed- and open-ended, with equity and debt strategies – putting us a country mile ahead of our rivals

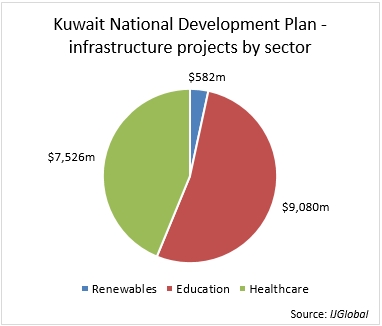

You queue and wait - Kuwait PPP

Renewables MENAKuwait has once again restructured its PPP agency to kick-start stalled projects. Despite numerous delays and setbacks, its infrastructure ambitions remain extensive

Ørsted's sale of 50% stake in Deepwater Wind

Renewables North AmericaEarlier this month Ørsted and Eversource agreed to collaborate on US Atlantic Coast offshore wind projects in a deal worth about $225 million for the second time

AMLO's new Mexican infra reality

Oil & Gas Latin AmericaThe cancellation of major projects and a lack of clarity on government plans are making international investors nervous about Mexico though the country's infrastructure need is still significant

Bulgaria's contentious energy mix

Renewables EuropeHuge uncertainty surrounds planned new nuclear power units and existing coal-fired plants in Bulgaria, which should create opportunities for other types of generation. However, renewable energy development and generation has slowed in the country in recent years

Long Son petrochemicals plant, Vietnam

Oil & Gas Asia PacificThailand’s Siam Cement has been on a patient 10-year long mission to build a petrochemicals plant in Vietnam

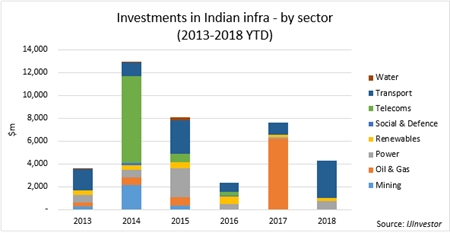

Investment in India gathers momentum

Oil & Gas Asia PacificIJInvestor data shows that international funds and institutional investors are already active in the market. There are 36 active funds focusing solely on India with a target of investing over $90 billion of capital

Nachtigal hydropower, Cameroon

Power Sub-Saharan AfricaWhat was originally planned as a captive power project for a Rio Tinto smelter will become the largest hydropower IPP in Africa once constructed

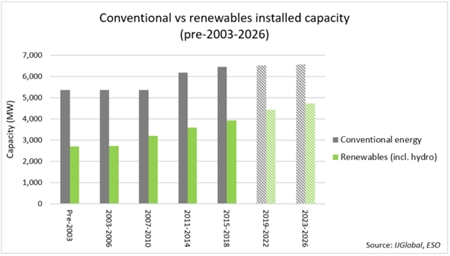

Infra funds – global fundraising

Renewables Asia PacificWhile 2018 failed to log a mega fund final close – something infra hacks love to hang a story round – this last year managed to break fundraising records across a slew of smaller vehicles, the vast majority of which are (not surprisingly) focused on equity

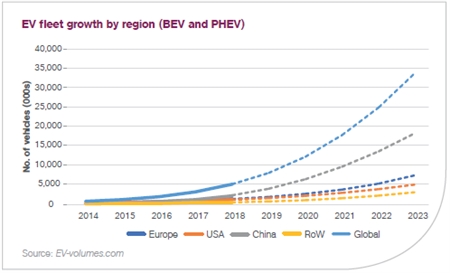

Charged with uncertainty - EV charging infra

Transport EuropeVarious public and private led funds are being raised in early 2019 targeting electric vehicle charging infrastructure. Private investors are battling with oil majors and energy utilities for dominance of this nascent market, as appropriate financing structures remain up for debate

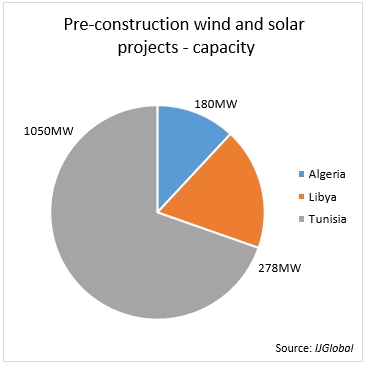

Renewables across the Sahara

Renewables MENANorth Africa has the weather conditions and large tracts of open land needed to support significant solar and wind power development

RGreen Invest’s InfraGreen III fund

Renewables EuropeFrench alternative energy fund manager RGreen Invest is approaching a February final close on its latest mezzanine debt and equity fund – InfraGreen III – above target and approaching an extended hard cap. It is the fourth fund vehicle under management for RGreen Invest, which partners with developers at the ready-to-build stage