Latest Analysis

Greencoat Capital Acquisition, UK

Renewables EuropeSchroders’ acquisition of a 75% stake in Greencoat Capital for £358 million is indicative not only of large asset managers’ readiness to make multi-million investments into the renewables sector, but also of the growing appetite for established platforms with proven expertise

Friday The 13th – Dawn of the Debt

Renewables EuropeWelcome to the Friday Editorial, dear friends. Pull up a seat. Make yourself comfortable as I have a chilling tale to tell you… one that’ll curdle your blood, turn your hair grey(er) and have you wailing in terror as you face your doooooom

Infra Dig Podcast – Gridserve’s Toddington Harper

Renewables EuropeThe future of electric vehicle charging has never looked brighter than it does right now as the market throws its weight behind this burgeoning sector, and UK-based Gridserve is right at the front of the pack

IJGlobal Awards – Standard Chartered Video

Renewables MENAHaving performed impressively in the MENA IJGlobal Awards 2021 – picking up trophies for 5 major transactions to have closed in the last calendar year – Standard Chartered takes time to run through its performance over the judging period and looks to the future

Don’t Panic – infra slumps happen

Oil & Gas EuropeHaving spent the last couple of weeks riffing off the funds report, it seems only fair now to gnaw knuckles and take a closer look at our first quarter greenfield report for infrastructure financing… which has a very different tale to tell

Acciona’s ISTP batch 2, Saudi Arabia

Water MENAAn Acciona-led consortium reached simultaneous financial close on a fleet of wastewater projects, the second such batch of ISTPs to have been procured by Saudi Water Partnership Company

Arcus takes transport Core+, Sweden

Transport EuropeArcus Infrastructure Partners in March set a second benchmark in Core + with the 100% acquisition of of an asset from Searchlight Capital Partners that – again – had the market wondering how it fits within the fund's mandate

Infra Dig – Interconnectors with Hitachi Energy

Power EuropeGiven the upsurge in activity on the interconnector front as nations increasingly focus on achieving energy security, the Infra Dig podcast series this week turns towards an interesting sector in the greenfield as well as secondary space

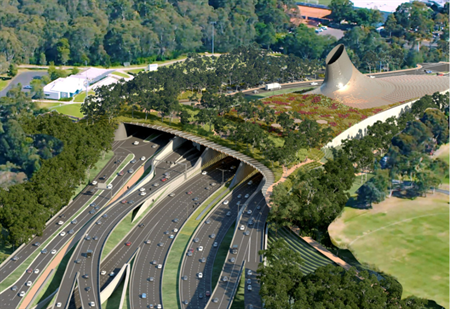

North East Link PPP, Australia

Transport Asia PacificThe North East Link PPP boasts several accolades, the largest PPP project to date in Australia and – most notably – the first such development in the world, or so they repeatedly claim, to be procured using the “collaborative contracting model” where the procurement authority assumes a portion of the construction risk

Araguaia Ferronickel Mine, Brazil

Mining Latin AmericaWith the nickel market’s prospects transformed after 2 years of intense focus on the practicalities of the energy transition, Horizonte Minerals last month closed a $633 million project finance package for its Araguaia ferronickel mine – a Tier 1 project which could bolster Brazil’s status as a long-term source for the world’s nickel needs

The great infra feeding frenzy

Oil & Gas EuropeIf you view the world in a certain way – say, looking at the global infra / energy sector as a gargantuan feeding trough filled with swill (assets), and the funds as a rotund set of piggies – well, it’d be entirely fair to say that the former’s overflowing and the latter have their snouts well and truly inserted

Bernhard acquisition, US

Renewables North AmericaIn December 2021, DIF Capital Partners announced the completion of its acquisition of Bernhard - the largest privately-owned Energy-as-a-Service solutions company in the country

Bulacan International Airport PPP Phase 1, Philippines

Transport Asia PacificAfter many years of hurdles and delays, Philippines conglomerate San Miguel reached the first step of materialising a $14 billion greenfield airport, which last month achieved financial close on phase 1's land development works

Infrastructure – the final frontier

Transport EuropeSitting at home bashing away at an aging laptop having spent last night in London with more infra funds than you should be able to squeeze into an extraordinarily large room, one cannot help but wonder where the market’s heading... might it be outer space?

Capital availability drives US project finance

Oil & Gas North AmericaThe project finance market has been especially dynamic since the start of the worldwide Covid-19 pandemic in early 2020. Here Will Marder of Wilmington Trust takes a look at how it has evolved in that time

Infra Dig Podcast – The UK Nuclear Plan

Power EuropeWith news published last week that the UK has committed to a massive investment programme in its energy generating estate, the IJGlobal podcast – Infra Dig – turns the focus on this interesting development