News+: UK Green Investment Bank open for business

The £3 billion (US$4.81 billion) Green Investment Bank is to be officially launched in Edinburgh today, heralding a new era for renewables and low carbon state investment in the UK.

IJ News was invited to meet with the Bank yesterday as it announced the first financings to be made by the fledgling investment bank, which was first mooted by the UK government back in the April 2010 Budget. It has since received state aid and EU approval as a lender solely to green projects and businesses - the first such state-led institution in the world.

Reiterating the bank’s role as a profit-making, competitive investor in viable, shovel-ready projects was a key priority at the launch yesterday. “We are not a lender of last resort, we are not a lender of grants,” chief executive Shaun Kingsbury said. Instead, the Bank aims to “focus on the short-term needs of the market”, bridging the gap towards long-term financing for a steady pipeline of UK energy projects.

The Bank announced its initial investments yesterday, which include:

- A proposal to provide financing for the UK Green Deal’s first contracts upon its launch. In the long term, the GIB plans to help the Green Deal Finance Company access long-term institutional finance to finance its work

- Through the Bank’s precursor, UK Green Investments, a series of investments in waste projects through the funds appointed to manage the cash. These include £5 million direct commitment by SDCL into Kingspan Group to improve its industrial activities; and a £16 million investment by Foresight - the mandated fund and asset manager - into a waste project in Teeside. Both investments are match-funded.

- Additionally Foresight said it is set to sign further deals early in the New Year.

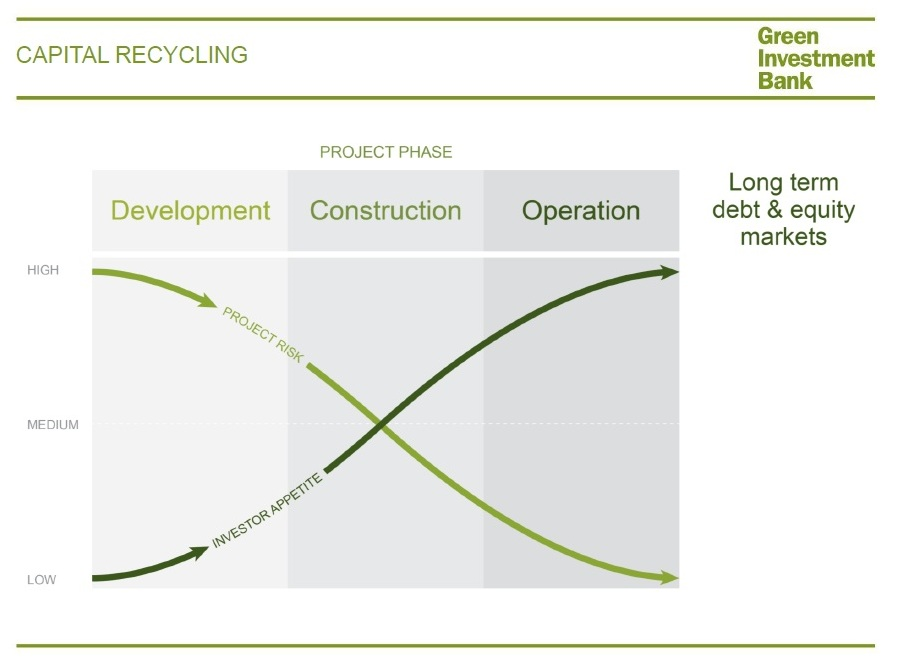

For one of the bank’s main priorities – mobilising investment in the UK offshore wind sector - Nolan cited constrained utility balance sheets, rating agency caution towards project debt and historic “overprojected” performance of online wind projects as major current barriers to getting projects financed in the UK. The GIB wants to “catalyse investment appetite at construction phase,” it said yesterday, and establish offshore wind as a recognised asset class with both institutional debt and equity investors.

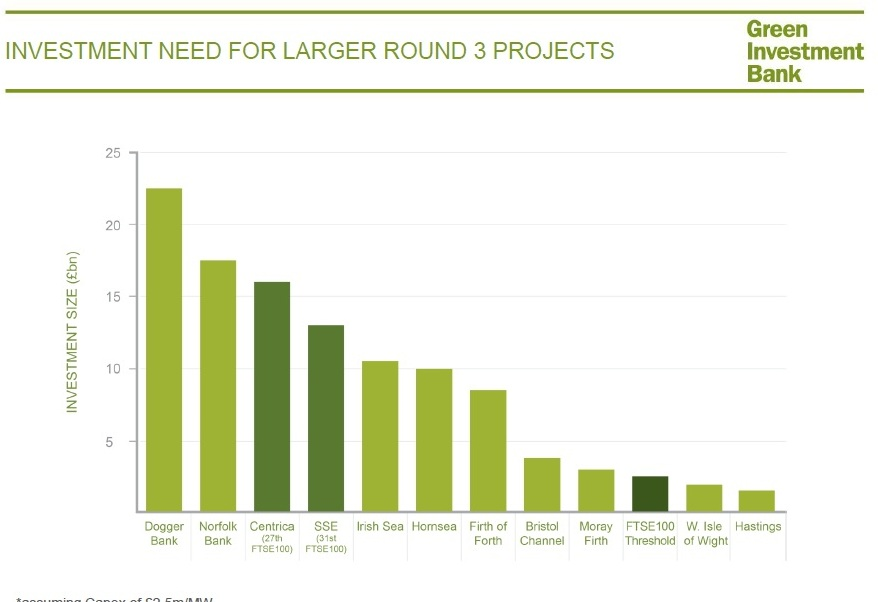

The first image below shows the GIB's reading of the current trends in investor appetite. The second shows the amount of capital investment required for the UK's next round of offshore wind - in comparison to some of the UK's largest utilities.

Source: GIB

Waste and bioenergy have also been singled out by the Bank as key investment areas. "In waste there's no question that investment is required. We still very much lag behind our Northern European neighbours, from recycling facilities to energy recovery," the GIB's executive director Adrian Judge said. Judge also cited government targets to reduce the amount of waste going to landfill as a reason for prioritising waste projects. The Bank is targeting already well-developed projects that require "a modest extra shove" to close. In time, the Bank says it hopes "to be regarded as the most knowledgable and experienced provider of capital to the sector."

The final investment priority for the Bank in its early stages is in domestic and non-domestic energy efficiency. The GIB said yesterday that 80 per cent of the current buildings in the UK are still expected to be in use in 2050, so projects involving retrofitting, CHP and on-site renewables will be favoured by the Bank as it looks to help bring down the national carbon output. Projects that improve the carbon standards of industry may also be considered, alongside infrastructure projects such as street lighting and smart meters.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.