News+: UK student housing in vogue?

At a time when most statistics reflect a downward trend in the construction sector across Europe and the UK, one asset class has outperformed - the UK student accommodation sector. According to a report published earlier this year by property consultancy firm Knight Frank, "Student property has performed exceptionally well as an asset class compared to traditional investments over the last year. In fact, it has outperformed every other commercial property class and delivered consistent returns throughout the economic downturn."

So what makes the sector so attractive? The straightforward answer is the demand-supply gap, but the increase in the number of students relative to the amount of avaliable housing is not the only reason. The majority of universities around the UK have not refurbished their student estates since they were first built in the '1960s-70s. These estates are now in desperate need of rebuilding in order to keep up with the latest student demands - both technologically and socially. These universities are now relying on the private sector for a complete overhaul of their student housing facilities.

On industry source told IJ News, "One third of the total university housing stock in the UK needs major upliftment over the next 10 years." Some estimates suggest that out of the total 300,000 student housing units around the UK, around 100,000 are in immediate need of refurbishment. In addition, universities are also experiencing a funding cut from the government. The government is increasingly only happy to fund the core assets of a university which include teaching and research facilities, however since student housing is considered a non-core asset most universities are now opting for a long-term off-balance sheet solution and inviting private companies to build their student estates. This is therefore becoming an increasingly attractive window of opportunity for private players in the otherwise constricted construction space.

The past 12 months have witnessed a series of project finance-type tender announcements by various universities around the UK for refurbishment or replacement of their ageing on-campus student homes stock.

Projects Snapshot

Name | Stage | Estimated costs (£,mn) |

|

|

|

University of Reading | Financial Close | £230 |

University of Essex | Financial Close | £70 |

University of Aberystwyth | Final two bids | £160 |

University of West of England | Bidding | £36 |

University of Hertfordshire | Preferred Bidder | £200 |

University of Edinburgh | Final two bids | N/A |

University of Salford | Bidding | £70 |

University of Manchester | Bidding | £100 |

University of York | Bidding | £50 |

Source: Infrastructure Journal

As universities continue to compete with one another to attract students in a higher fees environment, they realise that student housing facilities are a vital part of education infrastructure. Accommodation remains a top priority for most students, especially at the undergraduate level and for those international students who are setting foot in the UK for the first time.

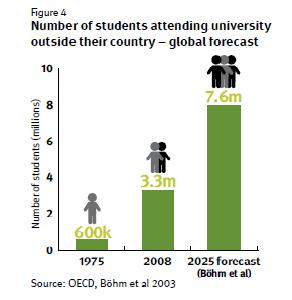

As Knight Frank's research shows, the number of students choosing to study outside their own country rose more than five times between 1975 and 2008 – and is forecast to more than double again in the next 14 years. "European and overseas students now account for more than a sixth of the UK student population, and we believe that this will only increase in the coming years."

Source: Knight Frank report, Student Property 2012

This undoubtedly puts pressure on the existing stock of student housing available in the UK and is a possible reason for the sudden surge in activity in the sector.

Challenges

While demand to build new student housing is high, the sector remains riddled with challenges and the two most prominent ones are procurement and financing.

Procurement - At a recent seminar held in London on the subject, a lot of international developers - that are heavily involved in the UK student homes market - were of the view that the procurement process (OJEU, tendering etc) is slow and that the cost and time attached to it makes it a huge barrier to entry for them. The UK student homes market is also considered to be atleast five to 15 years behind other mature markets like Australia, New Zealand and the US, according to some experts.

Picking the right private sector operator, proper assessment and transfer of the demand risk are also vital to the sector.

Financing - Broadly speaking there is limited long-term debt funding available in UK and rest of Europe and this extends to the student accommodation sector as well. While most of the student accommodation deals which are currently in procurement in the UK range between £100-150 million in construction costs, which may not be huge when compared with other infrastructure projects, their long-term nature makes it hard for them to seek financiers.

"The big issue today remains funding. When the University of Exeter closed its student housing project back in 2009 which was post crisis era there was still a club of banks that was interested but in today’s market we would be lucky if we get one or two," the industry source told IJ News. Nor have pension funds or capital markets been active in this space following the 2008 crisis and banks are wary of entering the space unless the university is able to provide financial guarantee or demand risk is clearly spelt out.

So in a scenario where banks have limited long-term tenor funding ability, universities are exploring other sources. Insurance major Aviva has been a key player in this space recently and already has two student accommodation schemes under its belt. The insurer is understood to be comfortable with the sector's demand risk.

Sources also suggest that institutional investors and bond players may return to the sector, and it has been rumoured that many are beginning to show interest in some of the recently tendered schemes. A return in such activity is not far from possible. The University of Sheffield financed its student accommodation PFI project through bonds back in 2006.

Other issues like the recent university fee hike and the strict UK border regulations surrounding student and employment visas have raised concerns about the demand for new student housing. However these issues are not likely to have a huge impact on student housing and certainly not in the short to medium term, according to the Knight Frank report. More students will be seen opting for quality universities but a drop in demand is not expected.

Overall the heightened activity in the sector is expected to continue and there is hope that newer avenues of financing will open up as developers and financiers get more comfortable with the sector.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.