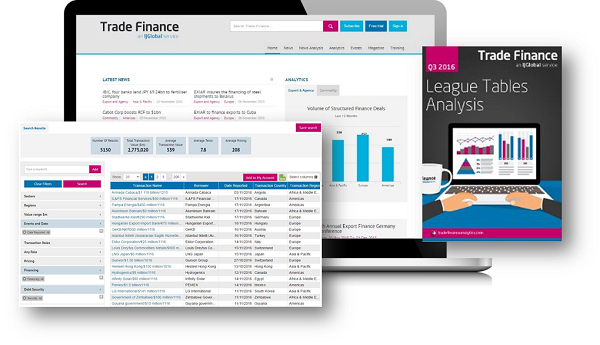

Trade Finance is an IJGlobal service that examines export, agency, structured trade finance.

Trade Finance combines daily news and analysis sourced directly from borrowers and lenders, coupled with the largest and most comprehensive database of big-ticket trade finance deals.

As export finance becomes an increasingly integral part of infrastructure financing, Trade Finance enables you to understand deals in the context of the market, the credit-worthiness of the borrower at the time, the risk mitigation techniques employed, the competitiveness of the pricing and with a comparison to past transactions by the same borrower and their competitors.

Optimised to add value to your business, Trade Finance Analytics provides you with:

|

|

Click here to visit Trade Finance, or contact us at helpdesk@tradefinanceanalytics.com to receive a complimentary trial.