Saudi Arabian renewables tenders

Saudi Arabia in early 2018 announced ambitious new plans to promote renewable energy as part of the kingdom’s long-term strategy to diversify its economy.

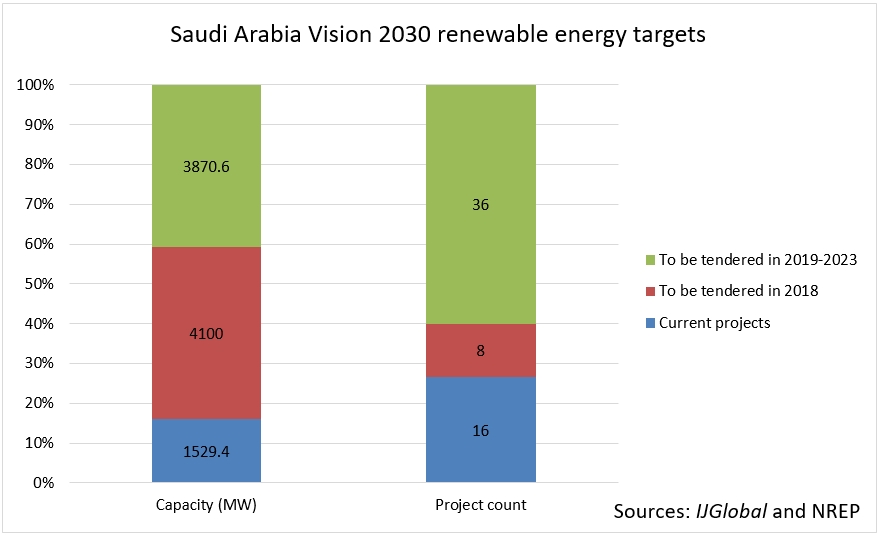

The kingdom is planning to tender a total of 3.3GW of solar capacity and 800MW of wind capacity this year, Turki Al Shehri, head of the Renewable Energy Project Development Office (REPDO) confirmed to IJGlobal in January.

Included in REPDO’s planned 2018 tenders are seven solar projects, as well as a single wind project, with a total investment cost in the region of $5-7 billion.

The effort is part of a wider procurement programme under the kingdom’s Vision 2023 plan, which looks to reduce Saudi Arabia’s reliance on oil for its domestic energy needs and possibly making it a renewable power exporter.

Saudi Arabia is aiming to procure a total of 9.5GW of renewable energy generating capacity by 2023, accounting for as much as 10% of the kingdom’s total power generation.

Kick-starting NREP

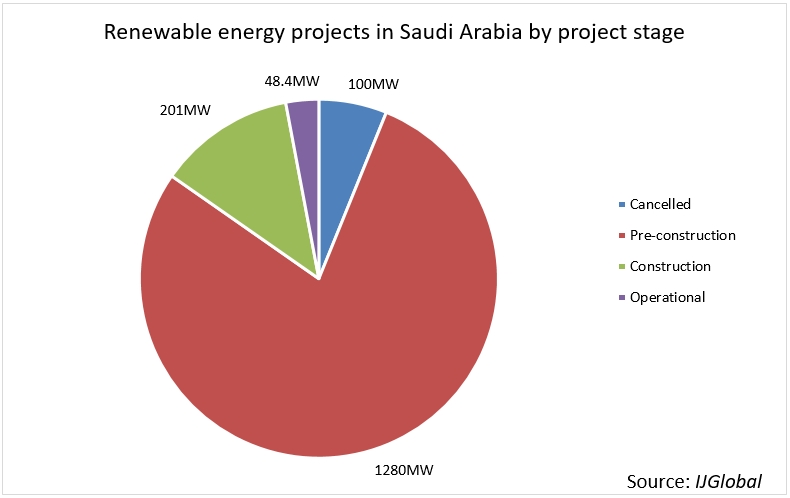

As IJGlobal data shows, the vast majority of the kingdom’s renewable energy projects are still in the pre-construction phase, and only a few projects have reached financial close so far.

A programme of renewable energy tenders has long been anticipated in Saudi Arabia, but the National Renewable Energy Program (NREP) only really got started in April 2017 when a request for proposals (RFP) was issued for the 300MW Sakaka solar PV project in the Al Jouf region.

Saudi Arabian developer ACWA Power was named preferred bidder for Sakaka and signed the 25-year PPA with offtaker Saudi Power Procurement Company in February (2018).

The project has an expected total cost of $300 million. Natixis has been leading the financing on behalf of ACWA Power, arranging a $240 million debt package for the deal structured as a 20-25 year soft mini-perm.

Sakaka is the first project to be tendered under the NREP. The facility is expected to reach financial close in the coming months, and is scheduled to enter commercial operations in August 2019.

ISCC projects

As well as standalone solar PV developments, Saudi Arabia is also developing integrated solar combined cycle (ISCC) power plants.

After years of uncertainty surrounding the project, the kingdom is now pushing ahead with the 605MW Duba 1 ISCC power plant. Duba 1 will be primarily powered by gas turbines – with concentrated solar power (CSP) generated via a parabolic trough collector delivering just 50MW of the plant's total capacity.

Another ISCC development also in the works is the 1390MW Waad Al Shamal project, again with a 50MW CSP component.

According to state utility Saudi Electric Company (SEC), Duba 1 and Waad Al Shamal have achieved the lowest CSP cost per installed kilowatt to date, dropping below $1,600. Typical stand-alone CSP units usually achieves prices between $4,000 and $8,000 per installed kilowatt, according to the International Renewable Energy Agency (IRENA).

Unsurprisingly, the Saudi flagship ISCC projects have attracted major international players as contractors. SEC in 2015 signed SR2.5 billion in contracts for Duba 1’s construction and operation with Spanish Initec Energia and SSEM, while GE was awarded a SR3.68 billion contract for the Waad Al Shamal project. Both facilities are expected to become operational in 2018.

Wind farms

Wind power also features in Saudi Arabia’s plans. These projects have been slower to advance, though two sizable wind farm are scheduled to be financed by the end of the decade. The 400MW Dumat Al Jandal will be the kingdom’s first utility-scale wind project, with operations planned to begin in mid-2020.

Another 400MW wind project is the Midyan wind farm located on the east coast of the Gulf of Aqaba, in the Tabuk province. The project stalled in 2017, but REPDO plans to retender it.

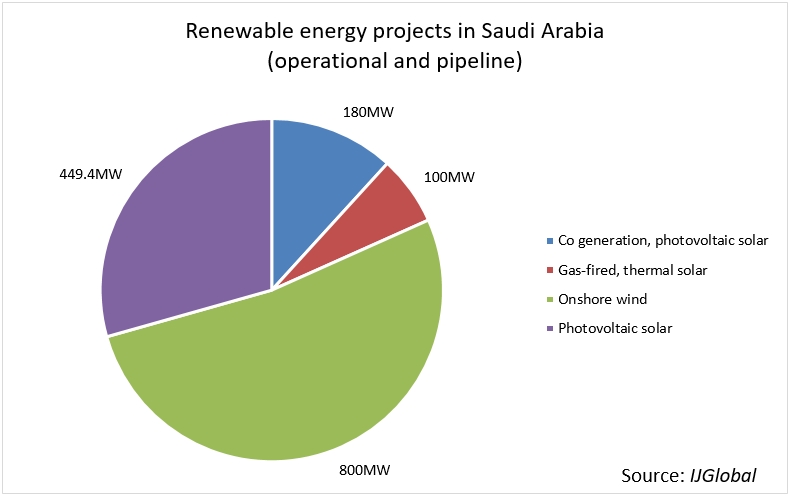

Although IJGlobal data shows that wind power represents the bulk of generating capacity in Saudi Arabia’s renewables pipeline, most of the upcoming tenders are set to be for solar or ISCC.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.