Data Analysis: North American Oil & Gas

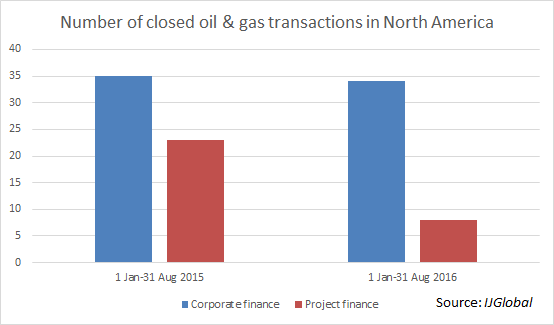

The depression in oil prices is having a sustained impact on the volumes of oil and gas project financings reaching financial close in North America, with asset owners turning primarily to the corporate space for relief, according to IJGlobal data.

While in the year-to-date both the number of project financings and their total value has declined, corporate financings have seen a comparatively marginal decline in value achieved through a higher volume of completed transactions.

This could be evidence that long-term project financiers lack confidence in the underlying value of oil and gas assets, or simply that owners are holding steady, waiting for better overall market conditions before going to market for long dollars.

The great bulk of the drop in activity came from a nearly complete eradication of primary financings—after 10 primary project financings and two primary corporates in the first eight months of 2015, there was only a single primary corporate financing completed by the end of August 2016. That was the Dominion self-financed Columbia to Eastover pipeline extension project, which will deliver gas to an International Paper plant in North Carolina.

While 17 project financings achieved close in the first eight months of 2015, with a combined value of $41.3 billion, the same period in 2016 has only seen six closes worth $7.7 billion—a 65% decline in volume and an 82% value drop. Meanwhile there were 28 corporate financings valued at $28.1 billion between January and the end of August 2015, as compared to 22 deals worth $32.6 billion this year.

Taking a broader look at total deal flow across the sector, the first eight months of 2016 saw a mere $38 billion worth of active projects in procurement, down from $133 billion year-on-year, and volume was more than halved down to 19 deals from 44 the year prior.

The major trend in the sector, noted in March 2016 by IJGlobal, has continued into the second half of the year: Most activity has been occurring in the midstream sector, where companies have been looking to dispose of assets in order to reorganize their balance sheets. This M&A activity has been sparked by reduced revenues due to oil prices being held lower than forecasts from a few years ago.

While Centrepoint Energy has yet to announce a divestment of its share in Enable Midstream Partners, Crestwood Equity Partners did offload a 50% share of its portfolio to Con Edison in June, and Husky Energy divested a majority stake in its midstream assets to companies controlled by Hong Kong billionaire Li Kashing in July. In total, there have been 10 asset acquisitions and four company acquisitions closed via corporate financing in 2016 to date.

Meanwhile the project finance space has seen only two refinancings close and four additional facilities.

With private equity hungry to continue acquisitions in the midstream sector, it is likely that this stream of deals will continue. However, with an analyst consensus forming that oil prices won’t rise up to $65 per barrel until sometime near the end of 2017, the market for primary project financings seems to be on hold for the time being.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.